By Sydney Sullivan

The stories you are about to read are relatively true with some poetic liberties, the names have been changed to protect the innocent. God took care of the guilty.

Karma comes from the Sanskrit word, karam, or action. The Law of Karma talks about the consequences of our actions. Or in other words, cause and effect. You may or may not call it karma, but for most of us, we have one of the following ideas already implanted.

- You reap what you sow –

- What goes around comes around –

- You get what you give –

- Life always come “full circle” –

How does this apply to bank foreclosure attorneys?

Continue reading

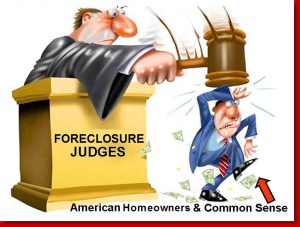

For all the talk about a divided America (mostly political that we shy away from on the DC blog), there is a HUGE group of people that can collectively agree we were screwed, smeared, and denied due process in courts that failed to follow the Rule of Law. This is the massive population of American Homeowners.

For all the talk about a divided America (mostly political that we shy away from on the DC blog), there is a HUGE group of people that can collectively agree we were screwed, smeared, and denied due process in courts that failed to follow the Rule of Law. This is the massive population of American Homeowners.