Category Archives: Legal

Maui ‘Ground Zero’ for Release of Billions of Biopesticide Lab-Altered Mosquitoes

By Michael Nevradakis, Ph.D.

the Defender, Children’s Health Defense

Up to 775,992,000 bacteria-infected mosquitoes could be released in Maui every week for the next 20 years, according to Hawaii Unites, a nonprofit that last month lost its bid to require the state to conduct an environmental impact statement before pressing go on the controversial project. the Defender, Feb. 6, 2024

Hawaii Unites in May 2023 sued the state in the Circuit Court of the First Circuit in Hawaii. The group’s president and founder, Tina Lia, told The Defender:

Continue readingFed’s Easy Money Fallout: Investors are Completely Unaware of This Leverage

Uncover the secretive realm of Private Equity (PE), a financial powerhouse born in the shadows of the ’40s. A power shift between fund managers and investors is shaking Wall Street, raising questions about market stability. 🏛️ As the private equity scam unravels, risk transfers from elites to “mini-millionaires,” potentially triggering the next financial crisis. 📉 Stay vigilant to navigate this financial maze and safeguard your interests.

The more you know. . .

The Great Taking

The Great Taking concisely explains what every American Homeowner and students who were pushed loans knew about the fraudulent securitization scheme. Homeowners tried to tell the courts and state attorneys general that these loans were not mortgages – but actually securities, and that the UCC laws had been changed in the mid 1990s which allowed the thieves to prevail in the pilferage of properties while the thieves wiped out the pension systems worldwide. Scroll down (they make it difficult for Rumble videos).

Take an hour and watch The Great Taking because whether or not you own a home or rent one – what is coming will directly affect you and you’ll want to be prepared.

“‘The Great Taking’ is a not-for-profit documentary produced by former hedge fund manager, David Rogers Webb, which alerts us to the privately-controlled Central Banks’ preparations for the inevitable financial collapse.

Continue readingThe Final Interview with Foreclosure Defense Expert Neil Garfield

This is a must listen to excellent interview with Neil Garfield by attorney Lance Denha and every American Homeowner must share with their local and federal political representatives. Neil is completely frank about the fraudulent securitization system. Neil left us with incredible truths about the foreclosure (aka land grab) system used by the makers and sellers of these fraudulent financial products.

Neil Garfield knew the “system”. He had worked in it – and he recognized the blatant fraud years ago. He set out his entire life to helping homeowner victims that were sold fraudulent financial products aimed at destroying middle class Americans. The system was rigged, the courts were complicit, the foreclosure attorneys sold their souls.

Continue readingMaui, Hawaii Fires, Red Flags, Fundraising and Donations

2

By Sydney Sullivan

The devasting fires of August 8, 2023 cannot be accurately described in just words.

The array of feelings range from tremendous pain and sorrow, depression, PTSD, and shell-shocked to being too pissed to cry. People want answers and when they don’t get honest or straight answers, the void gets filled with all sorts of chaotic theories – many of which may be real and others just sensational “news” to get views. The truth is, we just don’t know all of the facts yet or reasons for some of the asinine statements or actions from people we’re supposed to trust.

There is a lot to take into consideration here, who, what, where and why??? – and these are not easily answered questions. Maui is a melting pot of cultures and nationalities that love and celebrate each other bringing a whole new meaning to pot luck. The children are some of the most beautiful ever seen.

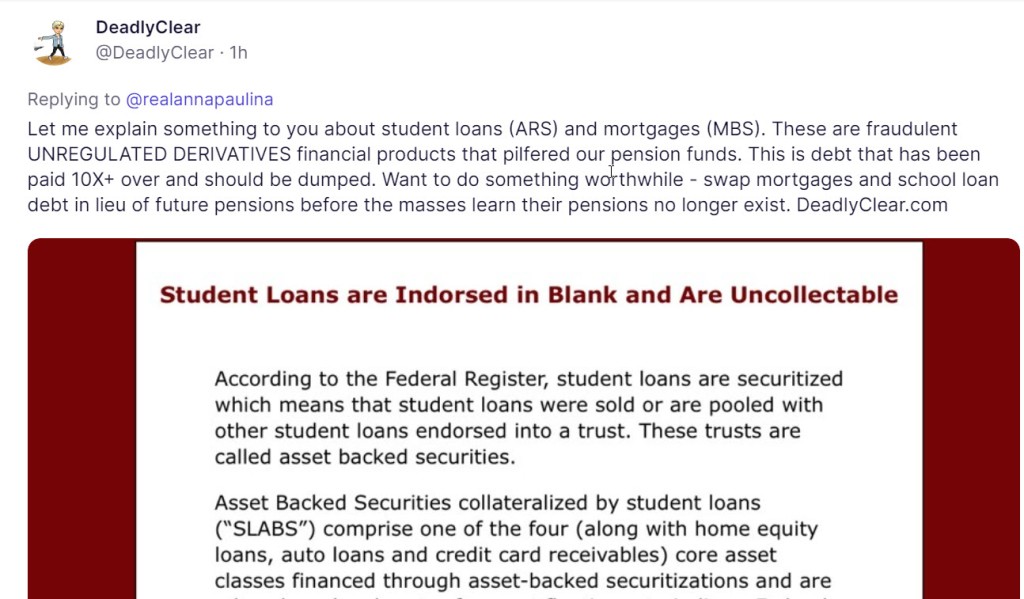

Continue readingStudent Loans are Indorsed in Blank and Are Uncollectable

See: Impact of Securitization and securitization-a-primer/

According to SEC rules student loans are supposed to be transferred into a trust; however they never actually deliver the note. If the note is NOT indorsed into the trust the note is void and uncollectable.

Continue readingThe Wizard of OZ – What’s it really about…

Contributed by a Subscriber –

DISCLAIMER: As with all video and editorial content shared on DeadlyClear.com, the content and its views are strictly that of its creators. Such views, opinions, and/or perspectives are intended to convey a story, are based on opinions and/or recollections about events in their lives on which conflicting memories may exist, and are not intended to malign any individual, religion, ethnic group, or company. Research is always encouraged, and comments are welcomed.

What Will Happen When Banks Go Bust? Bank Runs, Bail-Ins and Systemic Risk

By Ellen Brown / Original to ScheerPost

DeadlyClear Research and Editorial Staff

Financial podcasts have been featuring ominous headlines lately along the lines of “Your Bank Can Legally Seize Your Money” and “Banks Can STEAL Your Money?! Here’s How!” The reference is to “bail-ins:” the provision under the 2010 Dodd-Frank Act allowing Systemically Important Financial Institutions (SIFIs, basically the biggest banks) to bail in or expropriate their creditors’ money in the event of insolvency. The problem is that depositors are classed as “creditors.” So how big is the risk to your deposit account? Part I of this two part article will review the bail-in issue. Part II will look at the [UNREGULATED] derivatives risk that could trigger the next global financial crisis.

From Bailouts to Bail-Ins

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 states in its preamble that it will “protect the American taxpayer by ending bailouts.” But it does this under Title II by imposing the losses of insolvent financial companies on their common and preferred stockholders, debtholders, and other unsecured creditors, through an “orderly resolution” plan known as a “bail-in.”

The point of an orderly resolution under the Act is not to make depositors and other creditors whole. It is to prevent a systemwide disorderly resolution of the sort that followed the Lehman Brothers bankruptcy in 2008. Under the old liquidation rules, an insolvent bank was actually “liquidated”—its assets were sold off to repay depositors and creditors.

Continue reading