See: Impact of Securitization and securitization-a-primer/

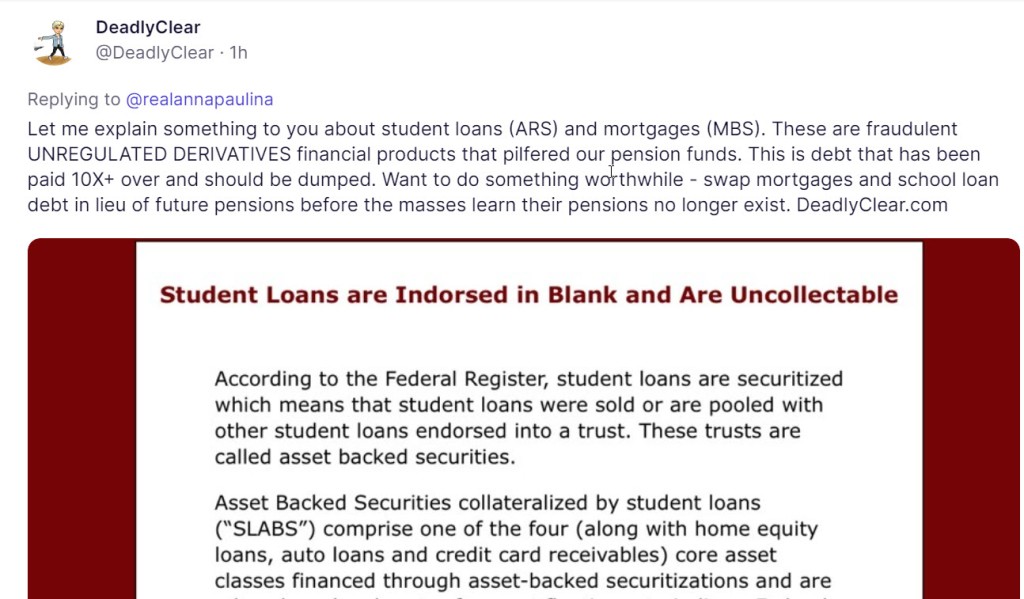

According to SEC rules student loans are supposed to be transferred into a trust; however they never actually deliver the note. If the note is NOT indorsed into the trust the note is void and uncollectable.

So what are they securitizing?

They are securitizing a COPY of that note.

All notes securitized by a transfer of the “borrower’s” or grantor is void and uncollectible. Also, securitization of a COPY of the note is a violation of the Uniform Commercial Code Article 9. If the note is not endorsed into the trust the note is void and uncollectable.

Student loan debt collectors violate the Fair Debt collection Practices Act because they threaten to take you to court and they have no intentions of doing so. In some cases this violation is worth $1,000.00 fine.

The Student Loan Contract

Student loans are governed by the United States Office of Education.

Most student loan borrowers will have the original contract in their possession because when they got these loans they got these documents and they faxed a copy on the contract to the loan broker so the company does not have the original. But in the contract it says that they don’t have it (and they know that) and that you agree to the terms and conditions by holding on to the original note

Student Loan Consolidation Store needs to send Student Loan contract documents and debt collection letter and a copy of your last monthly statement.

Administrative Process to Cancel Default Student Loan

I have yet to see where any money was used by the department of education that actually funded any loan and that’s what they say on these loans “your loan was funded by the Department of Education” when it wasn’t. It was funded by private investors, as a student loan security.

See letter from Sally Mae showing student loan default removed from credit report by my administrative process. Letter

See Also: http://studentloan2.com

http://articleatlas.com is here to present you with important articles that will assist your financial independence.

http://articleatlas.com/cancel-student-loans.html

See also: Securitization is NOT a “Traditional Mortgage Loan” Operation

[UNREGULATED] DERIVATIVE COMPLAINT – Blackrock, Pimco Sue U.S. Bank Over Trustee Roles

Coming Home to Roost – Congressional Oversight Panel, “Banks cannot prove they own the loans…”

“The REMICs have failed! “The REMICs have failed!”

FEDERAL RESERVE – Assets and Liabilities of Commercial Banks in the United States

3. Treasury securities are liabilities of the U.S. government. Agency securities are liabilities of U.S. government agencies and U.S. government-sponsored enterprises.

4. Includes mortgage-backed securities (MBS) issued by U.S. government agencies or by U.S. government-sponsored enterprises such as the Government National Mortgage Association (GNMA), the Federal National Mortgage Association (FNMA), or the Federal Home Loan Mortgage Corporation (FHLMC). Includes pass-through securities, collateralized mortgage obligations (CMOs), real estate mortgage investment conduits (REMICs), CMO and REMIC residuals, and stripped MBS.

5. Includes U.S. Treasury securities and U.S. government agency obligations other than MBS.

6. Includes MBS not issued or guaranteed by the U.S. government.

15. Includes student loans, loans for medical expenses and vacations, and loans for other personal expenditures. https://www.federalreserve.gov/releases/h8/current/default.htm

Why did the Federal Reserve and Treasury have to buy back these securities? https://wolfstreet.com/2021/05/17/who-bought-the-4-7-trillion-of-treasury-securities-added-since-march-2020-to-the-incredibly-spiking-us-national-debt/