UNJUSTICE

A Sydney Sullivan Story

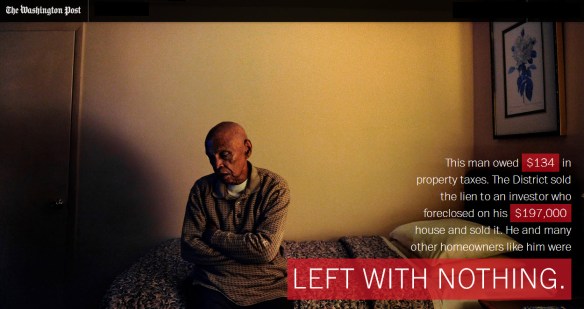

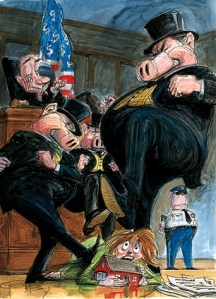

“Although inspired in part by a true incident, the following story is fictional and does not depict any actual person or event.” Photos throughout the fiction are to assist with your own imagination.

Ole stared directly at John G., “This is putting some bad law on the books, John – you can’t tell me this doesn’t bother you? I have to tell you both straight out that if I didn’t know about the pension fund issues, I’d think we’d look just plain incompetent… and I know some people are already saying that. We’re a pretty conservative community with a telegraph tree on the Internet. Every time I deny a homeowner’s foreclosure complaint it’s all over the social media. I’ve run out of creative ways to deny these homeowners and say, ‘you can appeal me, but you still have to move out, unless the appellate court gives you a stay.’ Now, you want us to go after a decent attorney just because he can’t be persuaded to quit his representation of homeowners?

Continue reading