(BREAKING NEWS – OP-ED) — FYI, NOT for use as legal advice … but for the added benefits of research! ICE OWNS MERSCORP … and things have changed! If you haven’t been paying attention to the “new and improved MERS”, you should be. As of October of last year, Intercontinental Exchange, Inc. (“ICE”; the same […]

Valuing a Secured Claim: Who Knew That Retail Price Could Be So Elusive

Bankruptcy-RealEstate-Insights

21st Mortgage Corp. v. Glenn (In re Glenn), 900 F.3d 187 (5th Cir. 2018) –

In valuing a mobile home for purposes of determining the amount of a secured claim for a chapter 13 plan, the bankruptcy court declined to include delivery and setup costs. The district court affirmed, and the mortgagee appealed to the Fifth Circuit.

View original post 726 more words

THE SYSTEM OF THINGS COMES HOME TO ROOST IN OREGON!

Very interesting! It’s about time.

Illinois Supreme Court: Mortgage Foreclosure Based Upon Payment Default is Same as Action on Note

Hat Tip to Daniel Khwaja, Esq.

Attorney at Law

ph (312)-933-4015

There are several points in this decision worthy of reading and digesting. The principal point interesting to me is that the court correctly decided that an action on a mortgage for nonpayment is the same thing as an action on the note for nonpayment. They are both alleging defaults on the same instrument — the promissory note.

The banks try to make a distinction particularly where they are filing a second or third or fourth lawsuit on the same deal based upon the same facts. In Illinois they have a very intelligent rule which says that if you sue and then take a voluntary dismissal, and they you sue again and take a voluntary dismissal they can’t sue a third time.

In Hawaii, the banks have brought nonsense to a whole new level…

View original post 1,302 more words

Another Glitch from Wells Fargo Admitted by WFB (oops 570 homes foreclosed.)

Glitch – yeah, sure!

Wells is trying to buy its way out if this one with offers of $25,000 to people who lost homes worth hundreds of thousands of dollars. This is the tip of the iceberg of liability for WFB, Citi, BofA, Chase and others who have very soft and porous balance sheets where liabilities are reported. Sure they have unreported trillions offshore, but the current reporting doesn’t come close to the actual liabilities of these predatory entities.

see Yes Another “Glitch” by Wells Fargo

To find out if you were one of the 570 start with finding out if Wells caused your foreclosure and the start digging to see how to determine whether your home was one of those foreclosed. We can probably help, first fill out our intake registration form. (FREE) CLICK HERE TO SUBMIT REGISTRATION.

It may seem like free money but actually it is blood money. They owe you…

View original post 26 more words

200 Million of the Most United Group of Americans in the United States – Wrongful Foreclosure American Homeowners

By Sydney Sullivan

For all the talk about a divided America (mostly political that we shy away from on the DC blog), there is a HUGE group of people that can collectively agree we were screwed, smeared, and denied due process in courts that failed to follow the Rule of Law. This is the massive population of American Homeowners.

For all the talk about a divided America (mostly political that we shy away from on the DC blog), there is a HUGE group of people that can collectively agree we were screwed, smeared, and denied due process in courts that failed to follow the Rule of Law. This is the massive population of American Homeowners.

The majority of over 84 MILLION families were unwittingly lured into a corrupt Wall Street securities scheme that cost them their clear title properties and in some cases their lives or the lives of their loved ones. American Homeowners can easily collaborate and identify with each other because the same crimes were committed over and over on each of them. Talk about a united, cohesive bunch of people – we are the American Homeowners! Continue reading

Fake Evidence and False Representations

“Here is the truth: no lawyer at any foreclosure mill ever gets a call or even an email from the named foreclosing party nor anyone else. Instead it is all automated in the loose meaning of that word.” USPTO patented automation.

Foreclosure defense litigants usually find themselves in a fog of questions they can’t answer. That is because the banks are using a tactic that I have called “step-over.” If they can’t prove an essential element of a case they step over it and pretend it was already established before.

ADMIT NOTHING. ASSUME NOTHING.

Let us help you plan for trial and draft your foreclosure defense strategy, discovery requests and defense narrative: 202-838-6345. Ask for a Consult.

I provide advice and consultation to many people and lawyers so they can spot the key required elements of a scam — in and out of court. If you have a deal you want skimmed for red flags order the Consult and fill out the REGISTRATION FORM. A few hundred dollars well spent is worth a lifetime of financial ruin.

PLEASE FILL OUT AND SUBMIT OUR FREE REGISTRATION FORM WITHOUT ANY OBLIGATION. OUR…

View original post 634 more words

BRUCE JACOBS IS FIGHTING BANK OF AMERICA!

“Jacobs said he was stunned to learn through discovery in another case more than a year later that Bank of America had ordered SourceCorp to purge its records.

“And what I found out later is that as I’m going though that whole process, Bank of America has ordered SourceCorp to do a military-grade purge of all of their records, everything: 1.88 billion objects of data, metadata, encryption keys,” he said.”

Well, guess if destroying evidence works for Hillary Clinton, why not BofA? Jacobs ought to ask NSA for help. The way things are going these days, NSA, China and/or Russia probably have all the original BofA meta data, emails, texts messages and inter-office memos in their systems. Wouldn’t that be a kick?!

Bank of America v. Reyes-Toledo (October 9, 2018) (Reyes-Toledo 2) — Hawaii Supreme Court Frees Hawaii Homeowners from Decades of Wrongful Federal Judicial Interference with Their State Court Foreclosure Defense Rights

October 14, 2018

TODAY’S SHOW HAD TO BE CANCELLED DUE TO AN EQUIPMENT MALFUNCTION AT THE AM RADIO STATION THAT SENDS OUT OUR SIGNAL TO THE WORLD. ALL OF OUR SHOWS ARE BROADCAST LIVE FROM OUR LAW OFFICE TO THE RADIO STATION WHICH TRANSMITS OUR SIGNAL.

AS A RESULT, THIS SUNDAY’S SHOW WILL BE BROADCAST NEXT SUNDAY, OCTOBER 21, 2018.

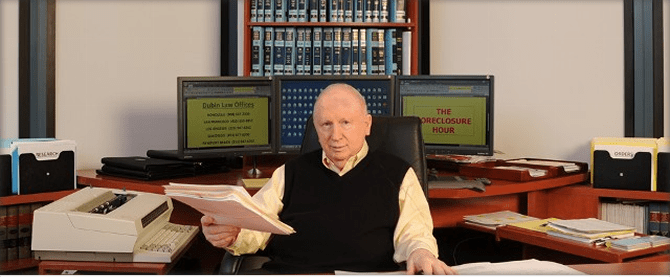

WELCOME TO THE FORECLOSURE HOUR

Your weekly national foreclosure talk show.

Listen in. Call in. Make your voice heard.

Your Host: Attorney Gary Victor Dubin

with

Co-Host: Former Hawaii Governor John D. Waihee

Foreclosure Workshop #70: Bank of America v. Reyes-Toledo (October 9, 2018) (Reyes-Toledo 2) — Hawaii Supreme Court Frees Hawaii Homeowners from Decades of Wrongful Federal Judicial Interference with Their State Court Foreclosure Defense Rights, Which New Published Opinion Should Become a Model for Every State Judiciary

I have mentioned on numerous shows that the federal courts are generally a virtual graveyard for homeowners being foreclosed on, and I meant that as no exaggeration.

For I have been an eye-witness advocate to decades of the mindless arrogant slaughter of homeowners’ rights in federal courts, generally ignoring Truth-in-Lending rescissions, ignoring loan modification abuses, ignoring the lack of good faith and fair dealing in nonjudicial auctions, ignoring the adequacy of notice pleading, and ignoring the many fraudulent and undisclosed low visibility practices within MERS and REMIC securitized trust paper hocus pocus mumbo jumbo. Continue reading

Not So Innocent: Transfer of Servicing Rights

When we receive the “new servicer” letter maybe in our QWR we should request the name of the loan boarding person (it should be readily available on the software platform) for our records. It could prove invaluable at some later date.

Fundamental questions:

- How can a “trust” change trustees without consent of the Trustor and/or beneficiaries? Is this statement true: The position of being a Trustee for a REMIC Trust is a salable, transferrable commodity that can take place without the knowledge or consent of the Trustor or the Beneficiaries? Hence were all those changes in Trustees void or invalid and who has standing to complain about it? If there is no Trustor and there are no beneficiaries it isn’t a Trust so no consent from the trust is required. That still leaves open the question “if not the trust, then who?”

- How can a “trust” change servicers without the consent of the Trustor and/or beneficiaries? Is this statement true: Servicers can decide amongst themselves as to who will be designated the “servicer” on performing and non-performing loans without the consent and knowledge of the creditor. The corollary is that homeowners…

View original post 1,028 more words