“Shortfall” – a clever term for “we’ve lost your money”

According to the Hawaii Free Press quoting the Honolulu Star Advertiser:

“The two public funds designed to meet the future pension and health care needs of government employees and retirees are a combined $25 billion in the hole with a growing shortfall….

The deficit in the ERS pension fund rose to $12.93 billion in the fiscal year ended June 30 from $12.44 billion in the previous fiscal year, according to one of the reports. The funded ratio — what is needed to meet future obligations — improved slightly to 54.9 percent from 54.7 percent a year earlier….

Similarly, the EUTF shortfall for all employers rose to $12.15 billion in fiscal 2017 from $11.78 billion in fiscal 2015, the last year it was reported. Its funded ratio improved to 12.8 percent from 6.7 percent because the cost of health care didn’t grow as fast as had been anticipated and because employers made more contributions to pay down the unfunded liability than required. The EUTF report has been coming out every two years but will be switching to an annual format… Continue reading

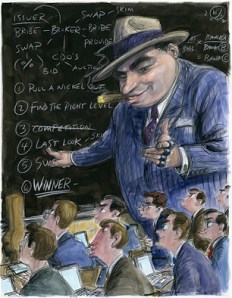

claims that it had routinely overstated the quality of mortgages it was selling to investors. But how did the bank avoid prosecution for committing fraud that helped cause the 2008 financial crisis? Today we speak to JPMorgan Chase whistleblower Alayne Fleischmann in her first televised interview discussing how she witnessed “massive criminal securities fraud” in the bank’s mortgage operations. She is profiled in Matt Taibbi’s new Rolling Stone investigation, “The $9 Billion Witness: Meet the woman JPMorgan Chase paid one of the largest fines in American history to keep from talking.” Click

claims that it had routinely overstated the quality of mortgages it was selling to investors. But how did the bank avoid prosecution for committing fraud that helped cause the 2008 financial crisis? Today we speak to JPMorgan Chase whistleblower Alayne Fleischmann in her first televised interview discussing how she witnessed “massive criminal securities fraud” in the bank’s mortgage operations. She is profiled in Matt Taibbi’s new Rolling Stone investigation, “The $9 Billion Witness: Meet the woman JPMorgan Chase paid one of the largest fines in American history to keep from talking.” Click