This about sums it up perfectly. Nobody knows better the corruption in the court rooms than the American Homeowners.

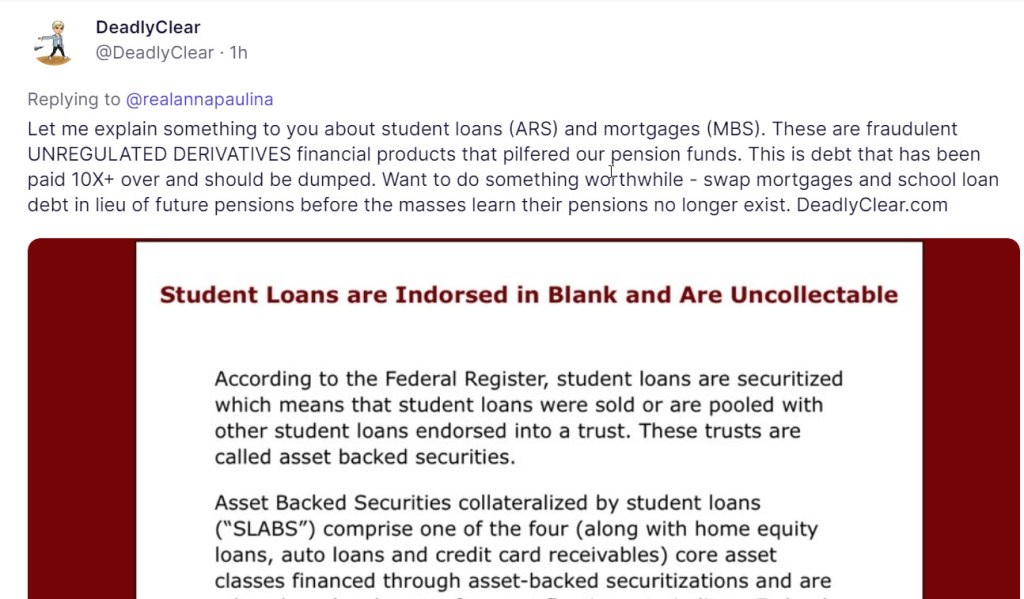

For 17 years American Homeowners have fought the banksters and their fraudulent UNREGULATED DERIVATIVES securitization scam – some successfully, some not.

BOTTOM-LINE – We’re tired of the fabricated documents, cleverly worded, but still false declarations, failure to prove standing – and especially using significantly reduced photocopies of an alleged Promissory Note, undated allonges and/or unsigned endorsements left “in blank” to further their fraud. Along with fraudulent Assignments of Mortgage, created or ordered by questionable law firms for the banks and many times back-dated, if dated at all. And let’s not forget the lower court foreclosure judges that let the Plaintiff Bank get away with it!

Continue reading