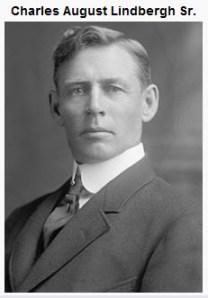

Jim Puplava is Author & Host of Financial Sense & Financial Sense Newshour  providing weekly broadcasts and writing thought-provoking commentary for Financial Sense Online in addition to interviews with top financial thinkers.

providing weekly broadcasts and writing thought-provoking commentary for Financial Sense Online in addition to interviews with top financial thinkers.

In a riveting interview on the banking industry, Christopher Whalen of Tangent Capital Partners in New York joins Jim on Financial Sense Newshour to discuss the fallacy of “too big to fail,” conflicts of interest in the derivatives markets, problems with the 2005 bankruptcy laws, and political failures, policies and programs.

In a riveting interview on the banking industry, Christopher Whalen of Tangent Capital Partners in New York joins Jim on Financial Sense Newshour to discuss the fallacy of “too big to fail,” conflicts of interest in the derivatives markets, problems with the 2005 bankruptcy laws, and political failures, policies and programs.

Chris Whalen elaborates on the present economic situation and why we are not seeing the changes Americans expect. Continue reading