Sometimes you need to take a risk when you believe passionately enough about something. Mark Stopa who has broken ground several times in defense of foreclosures is among those lawyers who are challenging the Florida 3rd DCA. Tom Ice has joined him in complaining about PCA opinions from the 3rd DCA. It seems this appellate court is refusing to give opinions or guidance on key elements of the foreclosure suits filed by “strangers” to the action. And the way they are doing it is by issuing rulings that merely say “Per Curium Affirmed” (“PCA”) in favor of the banks. Thus the appellate panel avoids getting into the complex issues involved with the false securitization of mortgage loans. This District Court of Appeal is steadfastly avoiding giving their rationale, reasoning or basis for their ruling leaving virtually all lawyers within their district with zero guidance on what to tell…

View original post 789 more words

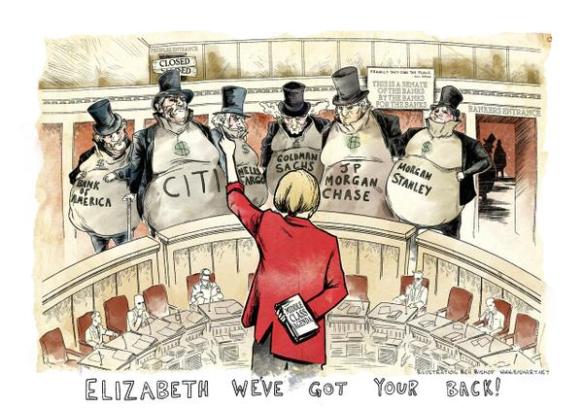

Banksters: Living the thug life…

Banksters: Living the thug life…