Working in foreclosure defense across the country it was easy to see the correlation of Trump states with securitization corruption. It was amazing to watch an entire year of campaign speeches and never once hear from either side about Wall Street foreclosure corruption. Not one debate question asked about a subject at the very core of our economic decline.

Over 72 million homes were MERS marked for a national registry that ultimately leads to another globalization plan. 72 million homes = over 140 million Americans whose properties, whether they know it yet or not, have been compromised by undisclosed securitization securities transactions and rehypothecation. Let’s face it – HAMP is just another failed Obama program. See https://deadlyclear.wordpress.com/2012/09/12/chapter-8-foaming-the-runway-hero-neil-barofskys-bailout/

However, it’s not surprising that the main street media, like CNN, slanted reporting when its top institutional inventors include JPMorgan Chase, Bank of New York Mellon, State Street, Blackrock and other fine Wall Street Hillary supporting entities…see https://finance.yahoo.com/quote/TWX/holders?p=TWX … not to mention the fact that George Soros makes major donations to broadcast and cable companies.

No doubt Mr. Soros is well-versed in fraudulent foreclosures as he stood in the wings ready to take over IndyMac Bank after Senator Schumer just happened to express his concerns about the bank. Small world, yeah?

With that said it becomes more apparent why the media and left-wing globalists don’t like Steve Bannon as he has expressed his Wall Street securitization views:

“And I think that’s incredibly important and something that would really become unmoored. I can see this on Wall Street today — I can see this with the securitization of everything is that, everything is looked at as a securitization opportunity. People are looked at as commodities. I don’t believe that our forefathers had that same belief.”

There is not a knowledgeable homeowner in foreclosure that wouldn’t agree with Mr. Bannon’s securitization opinion.

This is a guest post by Tom Adams, who spent over 20 years in the securitization business and now works as an attorney and consultant and expert witness on MBS, CDO and securitization related issues.

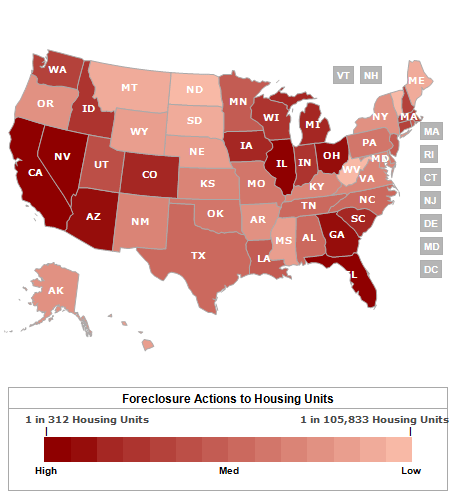

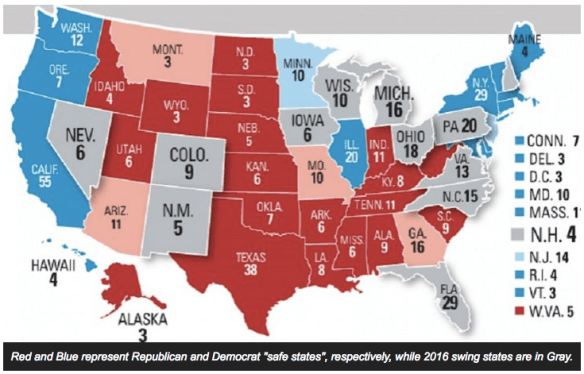

I don’t expect anyone to really come up with the perfect explanation for why Clinton lost and Trump won the presidential election. But I do spend some time looking at these maps:

The first map is from RealtyTrac, and indicates the states with the largest foreclosure inventory in 2012. The second is a map of the key battleground states. In 2008 and 2012, Obama won these states. In 2016 Clinton lost them. There’s a lot of similarities between those two maps.

Even in the best economic environment, residential mortgage foreclosure is a long, messy process. The massive wave of foreclosures that hit these regions after the financial crisis had enormous consequences economically. They also…

View original post 765 more words