February 28, 2013 – See Attorney Wendy Alison Nora’s Comment below –

ATTENTION ALL NEW CENTURY MORTGAGE HOMEOWNERS AND FORECLOSURE DEFENSE ATTORNEYS:

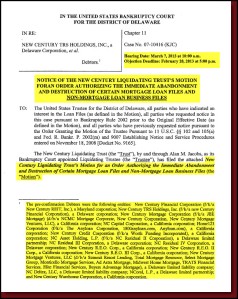

NOTICE OF MOTION TO DESTROY NEW CENTURY MORTGAGE LOAN FILES

On February 14, 2013, New Century Mortgage Liquidating Trust Trustee, Alan M. Jacobs motioned the court to allow him to destroy and abandon “certain” Mortgage Loan and Business files (Order Authorizing the Immediate Abandonment and Destruction of Certain Mortgage Loan Files and Non-Mortgage Loan Business Files). It is so immediate that respondents have only until February 28, 2013 to answer! Click here for the Destruction of Files Motion.

On February 14, 2013, New Century Mortgage Liquidating Trust Trustee, Alan M. Jacobs motioned the court to allow him to destroy and abandon “certain” Mortgage Loan and Business files (Order Authorizing the Immediate Abandonment and Destruction of Certain Mortgage Loan Files and Non-Mortgage Loan Business Files). It is so immediate that respondents have only until February 28, 2013 to answer! Click here for the Destruction of Files Motion.

Apparently, another ministerial act to eliminate evidence that New Century Mortgage failed to timely assign mortgage loans to securitized trusts. Thousands (if not millions) of New Century Mortgage loans have fraudulent assignments filed in state recordation

offices across the United States – and a lot of unknowing homeowners have clouded titles that with the destruction of their files – they may never be able to sort out the truth.

On April 2, 2007, New Century Financial Corporation and its related entities filed voluntary petitions for relief under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court, District of Delaware and is currently heard and administered by the Honorable Kevin J. Carey. With the filing of bankruptcy, New Century took down a list of affiliate / entities including New Century Mortgage Corporation, Home123 Corporation, New Century Mortgage Ventures, Midwest Home Mortgage, among a host of others. New Century was one of the largest subprime lenders in the boom times.

On April 2, 2007, New Century Financial Corporation and its related entities filed voluntary petitions for relief under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court, District of Delaware and is currently heard and administered by the Honorable Kevin J. Carey. With the filing of bankruptcy, New Century took down a list of affiliate / entities including New Century Mortgage Corporation, Home123 Corporation, New Century Mortgage Ventures, Midwest Home Mortgage, among a host of others. New Century was one of the largest subprime lenders in the boom times.

As we posted in Oh, New Century…What a wicked web you weave… (click for the link), the Court recognized that that securitized loans didn’t really belong to the estate and Judge Carey surely didn’t want millions of homeowners whining in his court about the frauds committed by New Century. Imagine endless days, turning into years, of motions for relief from automatic stay and adversary proceedings by homeowners who were duped by another fly-by-night mortgage company. A mortgage company where the SEC barred the three primary officers from serving as directors of public companies for five years, and levied fines and profit-disgorgement on the 3 officers…a pittance in comparison to the damage that they’ve done.

As we posted in Oh, New Century…What a wicked web you weave… (click for the link), the Court recognized that that securitized loans didn’t really belong to the estate and Judge Carey surely didn’t want millions of homeowners whining in his court about the frauds committed by New Century. Imagine endless days, turning into years, of motions for relief from automatic stay and adversary proceedings by homeowners who were duped by another fly-by-night mortgage company. A mortgage company where the SEC barred the three primary officers from serving as directors of public companies for five years, and levied fines and profit-disgorgement on the 3 officers…a pittance in comparison to the damage that they’ve done.

In any case, listening to millions of disgruntled homeowners would be a bankruptcy judge’s worse nightmare. Not to mention trying to sort through the securitization fiasco – that’s a lot of work, you know?

So, now after denying the alleged securitized loans a venue, the Liquidating Trust Trustee wants a bonfire of the records that might possible come back to haunt the estate or cause a great deal more work… because the issue of fraud still lingers and simmers as the next wave of foreclosures begins.

So, now after denying the alleged securitized loans a venue, the Liquidating Trust Trustee wants a bonfire of the records that might possible come back to haunt the estate or cause a great deal more work… because the issue of fraud still lingers and simmers as the next wave of foreclosures begins.

The Trustee’s Motion provides for responses – if you are lucky enough to even know about this… So, if you have a pen and piece of paper – take down this information and print a copy of the motion (click here):

“Responses, if any, to the relief requested in the Motion are to be filed with the United States Bankruptcy Court for the District of Delaware, 824 N. Market Street, 3’d Floor, Wilmington, Delaware 19801 on or before February 28, 2013 at 5:00 p.m. (prevailing Eastern Time).

At the same time, you must serve a copy of any response upon the following parties so as to be received no later than 4:00 p.m. (prevailing Eastern Time) on February 28, 2013.

1. Co-Counsel for the Trust, Hahn & Hessen, LLP, 488 Madison Avenue, 15th Floor, New York, New York 10022 (Attn: Mark S. Indelicato, Esq., Janine M. Figueiredo, Esq., and Christopher J. Hunker, Esq.).

2. Co-Counsel for the Trust, Blank Rome LLP, 1201 Market Street, Suite 800 Wilmington, Delaware 19801 (Attn: David W. Carickhoff, Esq. and Alan M. Root, Esq.)

3. The Office of the United States Trustee, J. Caleb Boggs Federal Building, 844 N. King Street, Room 2207, Lockbox 35, Wilmington, Delaware 19801 (Attn: Mark Kenney, Esq.)

In addition, if you have timely filed a written response and wish to oppose the Motion, you or your attorney must attend the hearing on the Motion scheduled to be held on March 7, 2013 at 10:00 a.m. (prevailing Eastern Time), in the courtroom of the Honorable Kevin J. Carey, United States Bankruptcy Judge for the District of Delaware, 824 N. Market Street, 5th Floor, Wilmington, Delaware 19801.”

Did ya get that? If you oppose this motion [click here for the Motion] and you live… say, in Hawaii… you have to make sure that you “serve” your objections by Feb. 28, 2013 5:00 pm to the Court in Delaware and to the Trustee’s attorneys in NY and Office of the US Trustee in Delaware by 4:00 pm (guess they don’t work as late as the Judge). AND if you object, you or your attorney MUST attend the hearing (wonder if they’ll allow for telephonic appearances?).

Did ya get that? If you oppose this motion [click here for the Motion] and you live… say, in Hawaii… you have to make sure that you “serve” your objections by Feb. 28, 2013 5:00 pm to the Court in Delaware and to the Trustee’s attorneys in NY and Office of the US Trustee in Delaware by 4:00 pm (guess they don’t work as late as the Judge). AND if you object, you or your attorney MUST attend the hearing (wonder if they’ll allow for telephonic appearances?).

Now, it doesn’t appear that the Trustee is treating this like any other motion – boy, he must really want to get rid of those files! Let’s make this as hard as we can on homeowners who would just like to be able to get access to their files – and for all of the millions of homeowners who don’t know they need it yet.

You know who should be objecting the loudest? The INVESTORS. Because the crux of the fraud was dropped in their laps since most of these loans were never timely assigned to the trusts if at all. But the INVESTORS aren’t going to yell too loud – because there is nobody to pay the IRS since the lack of assignments has actually killed the REMICs. But, if the trustee gets rid of the files, no need to worry – the proof is in the bonfire.

You know who should be objecting the loudest? The INVESTORS. Because the crux of the fraud was dropped in their laps since most of these loans were never timely assigned to the trusts if at all. But the INVESTORS aren’t going to yell too loud – because there is nobody to pay the IRS since the lack of assignments has actually killed the REMICs. But, if the trustee gets rid of the files, no need to worry – the proof is in the bonfire.

The banks have duped this Judge before – an by doing so made it appear that he had given his authorization for them to fabricate assignment documents as a ministerial act. Now, the Trustee wants to destroy the files… we know this is a long and drawn out bankruptcy – but so is the economic force majeure and destroying documents is not going to speed up a recovery or keep the banks from eventually failing. It will however, eliminate due process.

There are only a few days left to effectuate a response. If you have or had a New Century Mortgage loan or any one of its subsidiaries (Home123 Corporation, New Century Mortgage Ventures, Midwest Home Mortgage, etc.) contact an attorney to draft a response and request your file. It may be the only way you can preserve the evidence of your loan.

There are only a few days left to effectuate a response. If you have or had a New Century Mortgage loan or any one of its subsidiaries (Home123 Corporation, New Century Mortgage Ventures, Midwest Home Mortgage, etc.) contact an attorney to draft a response and request your file. It may be the only way you can preserve the evidence of your loan.

Getting the response in on time is paramount and served to all parties necessary. Surely there will be attorneys in the NY, NJ and Delaware area willing to represent hundreds of homeowners wanting to make sure they can retrieve their files.

If you are a foreclosure defense attorney and are willing to represent several hundred homeowners who would like to obtain their files from the New Century Mortgage Estate, please post your information in the Comments section below.

Please pass this information along to all your friends and family so that New Century victims may be alerted.

It is late here on the west cost….But not to late to object to this action to further cover up the fraud. I hope this post gets to the homeowners in time…….

The terrorist are Chase HSBC UBS BOA Wells Fargo City Ally and the rest of the big banks. Who we now know support Alqaeda drug cartels and the worst..HSBC AND UBS blantantly admitting it.

Indeed, and in fact is fact.

I have a new century loan need to get my files

Please call or email 951 757 1100 Bert

Do u have the files for chicago

@wankee veal

Read thru some of Abby’s posts on the blog. You still can call Hahn & Hessen in NYC and make request.

Suggest you also put request in writing to them. Call first.

If they have, they can send on a CD. It can take some time.

Hahn & Hessen represent the appointed bankruptcy trustee– they have opposed other homeowners in litigation up in that New Century bankruptcy

Blank Rome is law firm in Delaware which represents New Century (debtor) in its bankruptcy.

And one more thing- about the time the NCLT wanted to destroy docs– in court, some of the homeowners learned that the NCLT had discovered boxes of ‘branch’ copies of loan docs. If I recall correctly, these boxes of paper loan docs were stored in Iron Mountain and a second location. Iron Mountain is an underground storage cavern.

So they do have paper copies. One might have to get a subpoena to get those — so best to talk to your lawyer —

Bert my name is Wankee Veal

1519 S Kedvale

Chicago, IL60623 and i would like a copy please.

I feel bad for anyone involved with a New Century loan, that being said, has anyone looked at this situation from the point of view of this establishing precedent for any other bank to do the same thing? I am amazed and appalled that the BK court would even entertain this motion. Yes, there are only certian parties that have standing to oppose this, and they should. However, again, this sets up yet another bandwagon that other banks can and and will use in their efforts to obfuscate the truth about their ongong fraud.

In Florida, please contact The Law Office of Cox and Sanchez. http://www.coxsanchez.com/

I am at 727.896.2691 Ext:113. We are awake, we are alert to the forgeries, and we fight.

We’re down here in Georgia. Is there an attorney bold enough to stand for us? If so, please call me at 770.460.5219.

The Homeowner knows most about what really happened from the ORIGINATION of the loan. New Century was a subprime lender who did many sloppy predatory loans back in the day. i believe it is that documentation as well as the securitization issues that can speak volumes, even in court….and they will also wish to destroy these documents. There is the banking side and the legal side. It’s never too late to find out what all your options are based on BOTH sides of your equation. If the origination was a mess, chances are all the documents are a mess. Before spending thousands of dollars on litigation, KNOW WhERE you stand. IF YOU need help, check out getting a professional PARTNER. After all, the homeowner knows more than anyone. all they need is professional, trusted private guidance. http://www.myhomeowneradvocate.com

I just spoke to Co-Counsel to the Trustee of the New Century Liquidating Trust

HAHN & HESSEN LLP

488 Madison Avenue

New York, New York 10022

(212) 478-7200 – Telephone

(212) 478-7400 – Facsimile

Attn: Mark S. Indelicato

Mr. Indelicato advises that certain parties defendant in the bankruptcy case have agreed to pay the costs of storage of the loan files from 2004 and more recent for the indefinite future. He indicates that the loan files only have copies of the original signed documents and the original documents were delivered to the purchasers of the mortgage obligations. I asked him to the copies of my client’s collateral file. I am informed that the Trustee is not going to proceed with hard copy file destruction as long as the defendants in the unspecified case pay for the storage costs. I was given his e-mail address: mindelicato@hahnhessen.com to be put on a list of parties to be notified if the defendants are no longer going to pay for the storage of the copies of the loan files. There are images of the loan files from 2004 forward which will be maintained. Since New Century entities supposedly only have copies, images of the loan files which can be printed may serve to produce copies. I am surprised to hear that the loan files were actually delivered to the purchasers of the loans. If Mr. Indelicato is correct on my client’s loan file, I would have to seek production of the original file from the purchaser, believed to be a Morgan Stanley REMIC of which Deustche Bank National Trust Company is the named trustee. The “original” documents are necessary for inspection and examination by forgery experts. It is my understanding that delivery was done electronically, so it would be interesting to find out where the original documents are located.

I strongly recommend that everyone get put on the list for notification by the Trustee. I suggested that they should offer to sell the loan files to the borrowers and make a recovery for the estate. That would be a problem if they had the original notes but since they think they only have copies, they could make quite a recovery if they offered copies of the loan files for sale to the borrowers. I will continue to work on this angle.

Hello Wendy, I have been trying to obtain a purportedly paid note from Chase where New Century claimed to be the servicer and then Chase Home Finance became servicer. CHF claimed to be the holder in reconveyance but I was not provided the note at payoff since the closing of new loan in late 2007. I have questioned this since 2007 and was finally provided a COPY in late 2013. This copy has questionable endorsements from the orignal lender to New Century Mortgage which appears to have been modified to appear blank and is signed by Magda Villanueva – A.V.P./Shipping Manager. Chase acknowledged it delivers paid notes but is now saying the originator has the note. This is just one layer in the fraud from my case. If you can provide any info on updates of the New Century case or referrals for me to address my issues I would be very appreciative.

Hammertime-

If this comment makes it to you- please contact me. It is in regards to the same endorsement.

Stopthefraud leave me ur contact info or leave note, email here bit.ly/Si8EL5

Be aware that NC and Home123 had a scan and shred operation in Mexico.

I’ve confirmed that with a former counsel employed by NC and a former VP. Additionally one Diana Noriega was an employee who was in charge of that operation in Mexico and she claims to have spoken in Spanish to those who worked in that operation. It has also been told to me that entire loan files were sent there for scanning and shredding, including the notes. The VP put a stop to the operation eventually due to his concern about privacy and risk.

It is believed NC did this to save on costs of mailing around the loan docs, however it is my belief they did this to enable the digital sale of the same loan concurrently to multiple parties! There are some instances of double, triple and quadruple sales of the same loan.

NC has already sold all the loan data to an firm, run by an attorney, and this firm charges other firms for the data! Just how many times is Indelicato and the appointed Bkr Trustee Alan Jacobs going to sell the borrower data???? Why should borrowers now have to pay for suspect data??

Mr. Indelicato has mostly ‘hearsay’ to offer.

Abby, I did not see this post in time. My note had no endorsement in the first version faxed to me. The second version, produced as an exhibit to lift a BK had a stamped endorsement by Diana Noriega. How do I get more information about her? How do I find this Diana Noriega in order to depose her?

Used in a motion to lift stay — note endorsed by stamped signature of Diana Noriega — undated, in blank, trying to find Diana Noriega for deposition

Ps- notes are typically not dated when endorsed.

And you should verify this, but it is my understanding that ‘stamped signatures’ as a signature as an endorsement on a note is ok.

But you need to verify that. Of course who is endorsing and when did they endorse and were they authorized to endorse the note are critical to determine.

Try finding her in LinkedIn.

But — and I don’t know the timeframes surrounding your notes and any endorsements– but since NC has been in bkr since 4-2-2007 and after the appointed trustee took over in the Aug 2008 timeframe – when one pro se homeowner had him in the stand, Alan Jacobs stated that since he became trustee nobody should be signing documents but him.

You should talk to an attorney. You might be able to get discovery & documents from NC up in their bkr. If you want to try on your own you can call Mark Indelicato of Hahn & Hessen in NYC ( he is lead counsel for Alan Jacobs, the apptd bkr trustee) and request a cd with copies of any docs related to your l

Cont. related to your loan. And follow up with a letter to him with your request. You also may want to send copy to the bkr court in Delaware. Look up Bkr court in district of Delaware. Case number is 07-10416 KJC. Judge Carey is presiding.

Otherwise, and I’m not an attorney nor giving legal advice, but its my opinion you could consider doing something more formal up there.

I’d hurry to ensure nothing related to your loan is destroyed.

The NC is now called the New Century Liquidating Trust.

One more thing– more than likely Noriega left the employ of NC in 2007.

You can also ask Hahn & Hessen what was her last day of employment.

But don’t be surprised. We’ve seen Steve Nagy of NC still endorsing notes and signing assignments in 2012– even tho he left NC in Dec 2007.

The banks haven’t duped Judge Carey…read the transcripts, he has gone along with everything, knowingly! Read before you write this!

http://www.iprecovery.com/NewCentury.html

Here is the website of IPRecovery, which bought the loan data from the bankruptcy trust in the New Century matter.

from IPRecovery:

As part of the NEW CENTURY FINANCIAL CORPORATION bankruptcy proceedings, IP Recovery, Inc. recently purchased from the New Century Liquidating Trust a unique and comprehensive collection of loan origination data, servicing data, performance data, rejection data and broker data for loans originated/serviced by New Century between 1997 and its bankruptcy filing in 2007.

New Century was, of course, the second largest originator of subprime mortgage loans in the United States. At the time of its bankruptcy filing in March 2007, it was the largest subprime mortgage lender ever to fail.

IP Recovery, Inc. is making this data available on a non-exclusive, perpetual license basis so that you may analyze the data on your own equipment or access it, remotely, through a facility provided by IP Recovery, Inc.

A description of the data and its many applications follows below. For pricing details, database “screenshot” samples and answers to any specific questions that you may have, please contact Michael Garrett, Esq., at mgarrett@iprecovery.com, today.

I need help with releasing a lien from NCM corp. for a property in california. Please call 661-863-7755

I had to sell my home (New Century Mortgage) August of 2004 and

I have never seen any justice. I had that condo for almost 17 years

and had not been flipping deeds, etc. I am currently homeless and on

the street with a college degree and I had good references up until

this mess started. The State of Maryland Insurance Administration was

involved along with many other attorneys. I was constantly side-stepped.

I was a former state certified teacher for the State of Maryland and a

former wife of a teacher. I am 65 and living on the street with no help

from anyone financially. I want the truth who backed this loan and

why was I never given justice for now over 10 years, when I asked

for help from the “Authorities”. The original loan was with Standard

Federal Savings and Loan of Gaithersburg, MD. I have never been

a drug user, etc.

My sister who did work in California, keeps dumping me to the street.

Its not clear what happened to you. You sold your home in 2004? How does this involve New Century?

I’m in Michigan and was told my loan was discharged but never cleared from my lein, is there anyone in michigan that can help me. We are looking to refi but cannot because we can’t get any info on loan information.

I live in Texas, got a NC loan in 2006, at a very high interest rate. My loan was modified in 2011, everything was fine until Ocwen began tagging on fees, so much until we fell behind again. The extra fees totaled over $2000 in 2012 alone.

I went from a predatory lender to a predatory servicer.

How can I proceed to get rid of these parasites and have my lien cleared.

Check on DeadlyClear for the address to contact the NC bankruptcy Trustee and order a copy of your complete file before they destroy it. See EMERGENCY NOTICE: New Century Mortgage Trustee Motions to Destroy Mortgage Files | Deadly Clear https://deadlyclear.wordpress.com/2013/02/22/emergency-notice-new-century-mortgage-trustee-motions-to-destroy-mortgage-files/

I live in Upland CA New Century loan in 2005 Deutsche Bank National Trust Company claims to have purchased bundle of NC loans Deutsche hired Carrington Mortgage has my servicer…I NOTRIZED RESPA QUALTIFIED WRITTEN REQUEST & MERS DIRECTVE SINCE JULY 2013 FOR PROOF OF OWENRSHIP NO LUCK! NEW CENTURY SCAM IS MY NOTE PART OF POOL OF LOANS SOLD! WHO CAN HELP MY HERE IN UPLAND CALIFORNIA

……

In addition to your letters contact the NEW CENTURY Bankruptcy trustee and request your entire file. Also contact: report@DoctelPortal.com for help locating your loan. You’ll need to send us a copy of your mortgage and note. Send us a copy of your QWR, please. Let’s see how it was structured.

As of 9/12/2013, New Century is still in active bankruptcy in Delaware,

There is an Omnibus hearing scheduled today at 3pm EST.

The appointed bankruptcy trustee is Alan Jacobs and he is represented by the law firm of Hahn & Hessen in New York City.

Contact Mark Indelicato or Nick Rigano at that firm to request your mortgage loan files. They primarily have scanned images and can send to you on CD.

Give me their email That firm??

Contact Mark Indelicato or Nick Rigano at that firm to request your mortgage loan files. They primarily have scanned images and can send to you on CD.

Search on Internet for the firm and call them.

Hi thanks for your prompt response:

Who is BK trusteed for NC? & Will Doctel Portal be responsive? Speak to me in laymas terms.

There are a number of homeowner- borrowers fighting NC up in their bankruptcy in Delaware right now.

Suggest you contact an attorney should you be interested.

Several homeowner-borrowers negotiated cash settlements of 60k -80k. That court, as I understand it, would not be able to help you ‘save’ your home from foreclosure.

I NEVER RECEIVED FORCLOSURE NOTICE AS A MATTER OF FACT SINSE I SENT RESPS QWR THEY IGNOR REMODIFICATION JUST IGNORE ME! IM TREATED UNJUST!

And the appointed trustee Alan Jacobs is a consultant and is NOT a U.S. Trustee.

You might also find interesting the Missal Report. Search the Internet for it. Judge Carey ordered a special examiner for New Century bkr.

About 500 pages – details NC misdeeds and operations.

im going to reach out today who is appointed trustee Alan Jacobs and his email ill email everyone

My loan was a NC loan and was apparently sold to a US Bank trust in Nov. 2005. There are no records on file with my county that the loan transferred and my deed still shows NC as the lien holder. We are in ch.13 and the Ocwen/US Bank attorney has tried to default a few times – the relief from stay was ruled in our favor in 2009 stating that they had not established standing. Four years later they still have not done anything to make it legit. I cannot find my loan in MERS, Fannie or Freddie and all the attorney went to court with was a photocopy of the original note showing NC as lien holder. Colorado does not have many lawyers willing to jump in – including our own bk atty! We feel very afraid to send the RESPA QWA for fear Ocwen will try to accelerate default and forclosure. We are only two months behind, but always have been because of their fees and practices. We have not been current even when paying – they have done so many fraudulent things in the servicing of our loan – I actually live in fear of them. Advice?

QWR – sorry bad typing!

Sometimes writing a letter to your Congressional Representatives and US Senators helps. It may be that the bank/servicer has not filed your assignment yet because they don’t normally try to file the paperwork until there is a full default. It is assumed that they start collecting insurance after the 3rd month of default – you may not be behind far enough for the fabricated paperwork to be put into motion. If you know the name of your trust – look it up on the SEC site and order a certified copy of the trust documents. You may need them in the future for court. See https://deadlyclear.wordpress.com/2013/08/28/how-to-search-the-sec-for-a-securitized-trust/

Talk to your BK attorney about filing a 2004 Examination and also request a copy of your NC file from the NC bankruptcy trustee. If your BK attorney is interested there are several core foreclosure defense groups and law professors that will help him with your case and issues with the bank(s). Contact report@doctelportal.com and we’ll try to help him hook-up.

There are several NC cases with good outcomes for the homeowners. See https://deadlyclear.wordpress.com/2012/03/29/the-securitization-curtain-is-lifting-in-hawaii/

I bought my home in 2006 originally a NC loan, sold 4 times & now serviced by OCWEN, I sent in a QWR requesting proof of the right to service the loan. I am 7 months behind due to a work injury they responded that they did not have to give it to me and sent me a ledger of my payments. I don’t want to lose my home. What can I do?

My Servicer became Countrywide who screwed up the payments then tried to stick me with a higher payment that I could not afford. I submitted documents for a Loan Modification and each time I called for a status it was always in review. Next thing I know i get a letter telling me the Bank of America is now my servicer. And suprise they do not have my loan modifation request, so I had to start over, Again, it is under review was the only feed back i got for months. Quess what I get another notice of another new servicer SPS (Select Portfolio Servicing) And now the process starts again. But there is only a little information regarding this company and I am so apprehensive in dealing with them.

Phyllis, my mortgage has gone the same route as yours. New Century, Countrywide, BOA, SPS. I would love to compare notes. Please email me if you can.

cnalarson@gmail.com

Do we have any updates as to whether they have come out of bankruptcy yet?

@Sheryl

The case in Delaware federal bankruptcy court is 07-10416.

You can look it up in PACER, the court portal on the web.

However, as of Friday May 30, 2014, it was still open. It appears to be preparing to shut down and possibly very very soon — maybe within weeks.

Time is of essence if you plan to do something in that bankruptcy.

None of the homeowners who had contracts with New Century or Home133 Corp. were ever given notice of the bar date.

@Sheryl

Meant Home123 Corp., a subsidiary of New Century.

Those companies are gone since 2008.

It is now the New Century Liquidating Trust and the appointed bankruptcy trustee is Alan Jacobs represented by Hahn & Hessen law firm of New York City.

Thank you…

Oh my. My husband and I did business with NCMC not knowing what was going on at the time. Our mortgage contract has unmatched dates and clearly shows them doing business after their bankruptcy. The assignment date is at least six months later. Then we were stuck with Wells Fargo and just got back from court as they want to take our house. The assignment dates was our first argument. Judge gave us 60 days to come up with another argument as she abandoned state law in Texas and went with the federal decision of the 5th circuit court ruling. Does that make any sense? I’m far from a law expert! And I don’t know if this post is so old nobody will even read this but shopping for ideas on how we can keep our house and I must admit, it would be really wonderful to hurt WF, even if just a little bit! But is there a statute of limitations on the signing of the deed back in ’07? Was the request to destroy files approved?

Pingback: Incredible! New Century Bankruptcy Judge’s Order Against Homeowner Vacated… “[d]ue process affords a re-do” | Deadly Clear

I imagine I am a little late but I am being foreclosed now and strongly suspect a fraudulent assignment dated 6-29-09 signed by Mary Kist, VP from Collin County Texas. My loan was originally with New Century and assigned to Deutsche Bank National Trust Company as Trustee on behalf of Morgan Stanley ABS Capital I Inc. Trust 2006- HE6, Mortgage Pass-Through Certificates, Series 2006-HE6 c/o BAC Home Loans Servicing. Can any give me any information please??

@Joe

I can only give my opinion that you can still try to contact Mark Indelicato at Hahn & Heasen in NYC. U can find their phone # online.

Ask for all your loan files and any related documents. Ask they be sent to you on a cd.

If they still have – they should send to you.

That law firm represents the appointed bankruptcy trustee Alan Jacobs. They have battled mightily the homeowners who went to litigate in the New Century bankruptcy in Delaware.

Happy New Year!

That is Hahn & Hessen

Jon, I filed a Quiet Title Complaint here in Arizona against the same principals in your situation

for a client here,and I am about to receive a favorable ruling from the Court. you can reach me @ FACerraAssociates@gmail.com to discuss your situation. I am currently working with a client in

El Paso involving Wells Fargo Financial. Believe me when I tell you almost ALL of the big banks

have “Unclean Hands” and you can win in Court. I just received a home “Free & Clear” for a client here in Phoenix, Arizona on Dec.18th, 2014!!!

I have New Century for 2 loans somethings fishy about my loans being passed around now with SPS

You should try – locate Hahn & Hessen in NYC and fax them a letter requesting all loan files and related documents be sent to you in a cd.

Mark Indelicato is the partner who is in charge.

You can mail a copy to the Delaware Bankruptcy Court – attention Judge for the New Century TRS Holdings Bankruptcy Case 07-10416. State you are a homeowner and customer and you never received the bar date notice for the bankruptcy.

Note to you – the bankruptcy was filed 4-2-2007. No customer/homeowners/borrowers ever received the bar date notice.

You can search on Internet for the Hahn & Hessen website and they will send you that CD free of charge….. If they still have the particulars of your loan

i am being foreclosed on now and sale is scheduled for January 22, 2015 on a judicial foreclosure on a mortgage i was in the process of applying for when bankrupsy occurred and i never got funded but a note was made and sold to deuch bank without recourse but i never got a loan in the first place how can this happen? What can I do. Im in Washington state please call me if your willing to help me fight.Ive been on this property for 20 yrs with no mortgage owed now owe a mortgage I never got funded.

For privacy reasons we try not to post phone numbers. There are several good attorneys in the Seattle area who may be able to refer you to someone if that is not your area. This is a complicated subject and needs an attorney’s advice on how to handle. Keep us posted on your progress.

Tomas J not legal advice but u should be able to cancel the note with truth in lending act rescission. If as u say lawyers will make it more complicated to milk u dry. Leave email if want to get in touch.

Retain a good lawyer.

Also get on Facebook and look for Michelle Darnell. I think she is in Washington state. She is an advocate and up on WA laws.

I’d get the lawyer right away.

You signed loan docs but they never funded your loan. They still sold your note to an investor. Thats pretty corrupt of them

It appears that they sold the loan before you ever signed the faux mortgage and note documents – nemo dat.

I too would like my Files.

I would like my oroginal file from new century bank 2004 i take a mortgage out with them

Send a letter via fax or mail to the NC bankruptcy Trustee’s attorneys or call their office and follow up with a letter.

My home in the city of upland & was with New Century how can I find out if Carrington has my note or not?

It was likely securitized and supposed to have been in a trust. First, I would contact the NC bankruptcy trustee and request a copy of the complete file. You can ask them where the loan is and when was it sold. If you are not in default there probably won’t be an assignment to the trust yet. If you are in default the assignment(s) will likely be under the mortgage but not necessarily with your name. When I just want to know specifically where a loan is I use CFLA and ask Andrew for an “initial search” (310) 432-6304. It runs about $250. Then you can decide after you get the NC file – what to do next. The information will help your attorney.

Ok so ask CFLA Andrew and pay$250? Can I ask you BK means debt is canceled right? What happens to us the home owners what if we been paying and there no lieu of deed to anyone?!!!

New Century is still in chapter 11bankruptcy in Delaware. The bankruptcy trustee and his attorneys are indicating they are winding down and will be done with bankruptcy very soon.

If you need a copy of your loan files, I’d suggest getting them on cd from the bkr trustees attorneys at Hahn & Hessen in NYC.

Their contact information is within this section of the blog.

Hi

Hahn & Hessen is this for California homes as well? Sorry within the blog how do I open? sorry ignorant to this. I am concerned if I’m paying to a servicer illegally claiming my deed? I will contact Hahn & call that other number you said to….

Hahn & Hessen law firm in NYC is on the web.

Just search for that.

Tell them you need a cd with a copy of all your loan docs. Give them your original loan number with them.

Yes – their bankruptcy was for their nationwide business…….

Ok so I need to pay $250 to CFLA (who this?) ask for Andrew and then contact Hahn & Hessen, is this accurate? I won’t bug much more.

I cannot comment on the CFLA part.

Hahn & Hessen should be able to tell you if New Century sold your loan and to whom.

That being said, I could not advise you on how to learn of any other sales/transfers of your loan.

A QWR (qualified written request) to your servicer with an instruction for them to provide you with the identity of the current owner(s) of your loan and its contact information, should also work.

You can probably find a template for a QWR on the web. Make sure it uses some of the new Dodd-Frank Consumer Protection Act

verbage. Or, if you have an attorney he/she should be able to get you the information you require.

Pingback: Is New Century in Your Chain of Title? Act Now! | Livinglies's Weblog

Pingback: EMERGENCY NOTICE: New Century Mortgage Trustee Motions to Destroy Mortgage Files – sandrakblog

I have been to court where one Judge threw the case out now I am back in court I just want to know if this bank stealing my home or do they have rights so I can move on my health is not the best to keep going back and forth I sent in my information by email/phone hope to get some help soon,

Have sent several emails to BK trustee atty and was told they could help with file. Now after a follow up nothing not even a reply back. Any suggestions?

Get on the phone and call Hahn and Hessen in NYC and ask to speak to attorney Chris Hunker.

Jellybeans-

Have you spoke to this attorney? He does not show up on their website list of attorneys but will try calling.

Yes. He just sent me a letter about a month ago. Call their main number and ask the receptionist. Sometimes lawyers switch firms

But I just looked him up in Martindale Hubell and it has his H&H information.

CAll their main number.

Jellybeans-

Thanks. I will try them but according to his LinkdIn acct he left H & H last month.

Did he send you New Century BK docs? (if I may ask)

Appreciate any and all help.

He sent me a sworn declaration by Donna Walker. I was up in that bankruptcy fighting in 2009 onwards along with other pro se.

Most of us got settlements.

So, I had my docs sent to me on cd.

They are going to close the bankruptcy soon.

Call and ask to talk to Schnitzer. I think first name was Ed. Or the main attorney Mark Indelicato.

Jellybeans,

I too have a home with New Century as my originator. Went to make my mortgage payment July 2007 and had my wire transfer rejected. Was never notified of their BK and never knew what exactly happened until 2011. In early 2008 Countrywide jumped in and said they had my mortgage and told me I owed 25k (I did not) and set up foreclosure sale and I moved out but it was never foreclosed on. Years pass same process with BOA. No foreclosure then a year and a half later BOA starts sending statements again. Then in Sept 2012 SPS says they have my mortgage and when I sent a QWR the didn’t give me much. 2014 I move back in my house and SPS attempts foreclosure with Northwest Trustee starting with a notice of default in which I hired an attorney. (Stafne-Trumbull out of Seattle area who are fabulous attorney’s) and they sent a letter stating statute of limitations is past in which Northwest Trustee Service stops foreclosure and closes file. Then attorney sends QWR /FDCPA letter in which SPS provides a copy of a blank endorsed note with Steve Nagy signature on it. I’m confused as to how Steve Nagy signature got on my note when I was paying New Century post BK filing? I had a realtor friend of mine pull a title report. Nothing listed on title except New Century and us as owners. We’re planning on filing a quiet title soon but would like to know your thoughts?

all I know is that New Century’s chapter 11 bankruptcy may be shut down soon. The NCLT attorneys have recently filed a motion to do just that.

Perhaps you should talk to your attorney about that. It’s a Delaware bankruptcy.

I really cannot comment on your situation.

If you need your loan docs from NC, follow instructions within this blog.

Hi my name is Tonia l Presley my father James C Presley bought a home from his sister Ozella Presley who live in California, the house she sold him was in Goodyear AZ

15625 W Magnolia St

85338- 9782

My father took sick and was hospitalized and lost his legs, while he laid in the hospital she took it upon herself to go to my father’s home seeing she sold him the house she still had a keys ‘ 2006 she walked out that home with the papers, my father put the house in my name and I lost my father 12-20-06 OZELLA PRESLEY NEEDS TO BE IN JAIL SHE HEARTLESS, my father was a hard worker almost 30years in DETROIT EDISON PLANT IN MICH’

I NEED TO KNOW HOW DO I RETRIEVE MY PROPERTY,. I HAVE the OWNER OF RECORD FROM

#ORIGINAL APPROVAL LENDER

NEW CENTURY MORTAGE

#ARIZONA MORTAGE BANKER LICENSE NO.

BK 0906039

# PIN NUMBER

MAP22615348

#PROGRAM

SMART ARM

#AUTHORIZED FINANCIAL INSTITUTION TO

CONTACT

123LOan, LLC

HELP WE DONT DESERVE THIS PLEASE,,

I just found this information. We refinanced our home with New Century in 2004 just six years after purchasing at $81,000.00. I don’t know why but six years later my husband refinanced with New Century and took out a First Lien for $20,000.00 (Fannie Mae and Freddie Mac) over the the original purchase price. New loan was reset at $96,000.00. Our loan was purchased from Carrington in 2007. We now owe what we paid for the house in 1997. Stupid I know. I searched county records and found the Deed of Trust for our first house (1985) but other than the First Lien from 2004 I cannot find a filed Deed of Trust or any file transfer from New Century to Carrington. I’m looking for those documents but all I’ve found is a welcome letter from New Century. I had major surgery in 2007 leaving me disabled so I don’t have a clue ever recieving anything in the mail. Interest is 7.75% and I’m wanting to refinance as we’re 60 now. Not having much luck with that and we’re told we don’t qualify for HARP but the real question shouldn’t at least the Deed be on file in our county courthouse? Wouldn’t Carrington have to file transfer of lender or change of Trustee?

Hi. Some of us New Century homeowner victims fought up in that court. We even filed objections to the destruction of documents. They went ahead anyways and destroyed the papers. We had no attorney so we represented ourselves. That all being said, they may still have scanned electronic copies of your documents. So, I’d call the law firm in New York City of Hahn and Hessen (Mark indelicato was the lead attorney representing the New Century bankruptcy trustee) and ask them to send you a cd with any and all scanned images of your docs. You will probably need your loan number.

You can also try to get that same cd from a law firm called Blank Rome LLP in Wilmington Delaware. They represented New Century as the debtor in the bankruptcy case. I don’t believe either law firm will charge you for the data/scanned images in the cd.

You can try, however I have not dealt with them for several years.

The law firm addresses and phone numbers are easily found by searching the internet.

Thank you. I will contact them and see if I can get a cd. I have copies from N.C. but they don’t make a lot of sense to me. I know my husband’s salary in 2004 was not enough to qualify a loan of this size. The only document I’ve found filed at our county Courthouse is the First Lien. I appreciate your reply. Really wish I’d found this out earlier.

I’m sorry you didn’t have a better outcome in court but I’m not surprised.

There was a point when Fannie & the banks relaxed the underwriting programs. There is a USPTO patent that states that loan values were no longer tied to appraisals – but what the borrower wanted to pay. The banks didn’t care if you could qualify, hence “stated” income that was a lot of times made up by the loan officers. Banks wrote software for the purpose of foreclosure, not long term mortgages. It appears its all tied to Globalism and Agenda 21. Research.

I have called Hahn and Hessen. Left two messages on his voicemail. No return call of course. I’m planning on calling back.

I did speak with a woman at Blank Rome. I gave her the loan number and date of modification. She was very nice and told me she’d try and locate those records for me. It’s been over a week but with holidays I’m sure I’m on the back burner if at all.

@deadlyclear,

That’s exactly what’s going to happen if I can’t find a solution of some kind. I have good credit but am disabled so I don’t have the income to refinance for lower payments. My husband has a good salary but bad credit. Carrington has kindly run a hard credit check twice on both of us then my bank JPMORGAN did the same. That has affected both of us. We haven’t had a late payment to Carrington in years. It’s ridiculous. The papers from NC are numerous. I’ve yet to read them all much less understand. Part of the plan as you stated.

I get it. I’ve missed the cut off by years. Even so there should be a recording of Carringt

Basics would b to request qwr or verification of debt. Can get lucky and copies of notes to check endorsements match chain of title, docs.

Thank you. I’ll look into that as well. I think I’ll go to our county Courthouse and do my own document search as well as contacting the attorneys office.

I find it ironic….

Those that actually would benefit from lower interest rates, (those with very high interest rates) Would not have lost their homes if their interest rates were lowered. But, then , helping those challenged making their high interest loan payments, were never the lenders intentions. I wonder if high interest borrowers would have been given the “preferred lower rates”, would have not lost their homes. Anyone know how to research ?

See above Deadly Clear comment of January 8th.

The higher interest rates (usually LIBOR based ) which many New Century customer victims became beholden to, were as a result of the ‘stated income’.

In my case, I did provide proof of my income etc to New Century. However, at the closing a small box at the bottom of the documents was checked for ‘stated income’!

Stated Income means that your income in NOT verified.

That was a nifty little bit of corruption all to get high interest loans for the securitization pension investment scheme.