Weep no more my lady

Oh! weep no more today!

Bravo – Kentucky Attorney General Jack Conway!

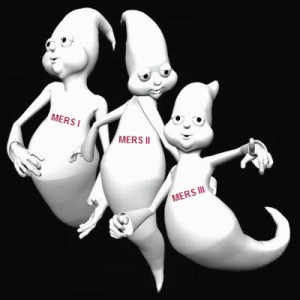

Attorney General Jack Conway announced that his office filed a lawsuit on January 23, 2013 in Franklin Circuit Court against MERSCORP Holdings, Inc., and its wholly owned subsidiary Mortgage Electronic Registration Systems, Inc. (MERS) for violations of Kentucky law. The lawsuit is a result of Attorney General Conway’s investigation of mortgage foreclosure issues in Kentucky.

Attorney General Jack Conway announced that his office filed a lawsuit on January 23, 2013 in Franklin Circuit Court against MERSCORP Holdings, Inc., and its wholly owned subsidiary Mortgage Electronic Registration Systems, Inc. (MERS) for violations of Kentucky law. The lawsuit is a result of Attorney General Conway’s investigation of mortgage foreclosure issues in Kentucky.

The lawsuit alleges that MERS violated Kentucky law by not recording mortgage assignments with County Clerks when mortgages were sold or transferred from one bank to another.

By law, mortgage assignments must be recorded in the appropriate County Clerk’s office and a $12 fee is collected by the clerks on behalf of the Commonwealth of Kentucky.

“Kentucky’s statute is clear. It requires assignments be recorded with County Clerks, and MERS directly violated that law by creating this system that provides no public record of sales or transactions and deliberately circumvents paying recording fees to states,” General Conway said. “The process makes it difficult for consumers to access data to find out who owns their loans, and the Commonwealth is ripped off when it comes to recording fees.”

MERS was created in 1995 to enable the mortgage industry to avoid state recording fees, allow for the rapid sale and securitization of mortgages, and shorten the time it takes to pursue foreclosure actions. Its corporate shareholders include, among others, Bank of America, Wells Fargo, Fannie Mae, Freddie Mac, and the Mortgage Bankers Association.

Currently more than 6,500 MERS members pay for access to the private system. More than 70 million mortgages have been registered on the system. The lawsuit alleges that since MERS’ creation in 1995, members have avoided paying more than $2 billion in recording fees nationwide.

Hundreds of thousands of Kentucky loans are registered in the MERS system. As a result of not publicly recording the mortgage assignments and paying the required fees, the lawsuit alleges that MERS violated Kentucky’s Consumer Protection Act by committing unfair, false, misleading or deceptive conduct. Under Kentucky law, MERS could be fined up to $2,000 for every violation.

“This process undermines the integrity of Kentucky’s public land records,” AG Jack Conway said. “Before the bottom fell out of the housing market, banks were bundling and selling loans on the securities market as fast as the ink could dry on the paperwork. When homeowners had trouble paying their mortgages during the economic downturn, they struggled to find out who owned their loans. It made it difficult to find out who to call to request a loan modification or to defend the foreclosure. There is and was no public record of the transfers.”

“This process undermines the integrity of Kentucky’s public land records,” AG Jack Conway said. “Before the bottom fell out of the housing market, banks were bundling and selling loans on the securities market as fast as the ink could dry on the paperwork. When homeowners had trouble paying their mortgages during the economic downturn, they struggled to find out who owned their loans. It made it difficult to find out who to call to request a loan modification or to defend the foreclosure. There is and was no public record of the transfers.”

[See also “MERS is not a “holder” under the plain language of the statute.”]

In addition, the lawsuit makes civil claims that MERS created this system to unjustly enrich and pad its bottom line at the expense of consumers and the Commonwealth of Kentucky. To view a copy of the complaint visit http://goo.gl/IqkxA.

Other states have filed similar lawsuits against MERS, including Massachusetts, Delaware and New York. What is you AG doing – maybe you should give him/her a call?

“I commend Attorney General Conway for taking action against MERS,” New York Attorney General Eric T. Schneiderman said. “The banks created this system as an end-run around the public property system and state recording fees. In Kentucky, New York, and across the country, these actions have left financially troubled homeowners in the dark about who owns their mortgages, making the difficult process of negotiating a modification or fighting a foreclosure action even harder. Attorney General Conway’s lawsuit is an important step towards accountability for these abusive practices.”

“I commend Attorney General Conway for taking action against MERS,” New York Attorney General Eric T. Schneiderman said. “The banks created this system as an end-run around the public property system and state recording fees. In Kentucky, New York, and across the country, these actions have left financially troubled homeowners in the dark about who owns their mortgages, making the difficult process of negotiating a modification or fighting a foreclosure action even harder. Attorney General Conway’s lawsuit is an important step towards accountability for these abusive practices.”

Attorney General Schneiderman and Housing and Urban Development Secretary Shaun Donovan chair the President’s mortgage fraud task force, which President Obama convened a year ago to build on the work of the mortgage foreclosure settlement.

Mortgage Foreclosure Settlement

In addition to the MERS lawsuit, General Conway joined 48 other state Attorneys General in negotiating the historic $25 billion national mortgage foreclosure settlement. The Attorneys General uncovered that the nation’s five largest banks had been committing fraud during some foreclosures by filing “robo-signed” documents with the courts.

Kentucky’s share of the settlement totals almost $58 million. Thirty-eight million dollars is being allocated by the settlement administrator to consumers who qualify for refinancing, loan write downs, debt restructuring and/or cash payments of up to $2,000. To date, the banks report providing more than $33 million in relief to 944 Kentucky homeowners. The average borrower received more than $35,000 in assistance.

Kentucky also received $19.2 million in hard dollars from the banks. The money went to agencies that create affordable housing, provide relief or legal assistance to homeowners facing foreclosure, redevelop foreclosed properties and reduce blight created by vacant properties.

To learn more about the settlement, visit www.ag.ky.gov.

The Kentucky State Song

My Old Kentucky Home

words and music by Stephen C. Foster

The sun shines bright in the old Kentucky home,

‘Tis summer, the people are gay;

The corn-top’s ripe and the meadow’s in the bloom,

While the birds make music all the day.The young folks roll on the little cabin floor,

All merry, all happy and bright;

By ‘n’ by Hard Times comes a-knocking at the door,

Then my old Kentucky home, goodnight.CHORUS

Weep no more my lady

Oh! weep no more today!

We will sing one song for the old Kentucky home,

For the Old Kentucky Home far away.They hunt no more for the possum and the coon,

On meadow, the hill and the shore,

They sing no more by the glimmer of the moon,

On the bench by the old cabin door.The day goes by like a shadow o’er the heart,

With sorrow, where all was delight,

The time has come when the people have to part,

Then my old Kentucky home, goodnight.CHORUS

The head must bow and the back will have to bend,

Wherever the people may go;

A few more days, and the trouble all will end,

In the field where the sugar-canes grow;A few more days for to tote the weary load,

No matter, ’twill never be light;

A few more days till we totter on the road,

Then my old Kentucky home, goodnight.CHORUS

You ould think with a case like this the judges would rule by the WA Supreme court law and they humbug this case in Washington Courts.MERS GOES DOWN IN FLAMES IN WA SUPREME COURT DECISION

Posted on August 16, 2012 by Neil Garfield

In questions certified from the United States District Court, the Supreme Court of the State of Washington En Banc concludes that MERS is not and cannot be a lawful beneficiary under Washington State Law. They decline to opine on the effect of the decision but the effects are obvious. They essentially said that only the real creditor (“the actual holder of the promissory note”) and who therefore has the power to appoint a substitute trustee could be a lawful beneficiary.

They rejected all arguments to the contrary, and reaffirmed that the power of sale is a “Significant Power” and thus the deed of trust should be liberally construed in favor of the borrower. The Court also reaffirmed the many decisions about the duties and obligations of trustees that have been routinely ignored by the banks and servicers. “… the process should provide an adequate opportunity for interested parties to prevent wrongful foreclosures.”

Their reasoning boils down to the old saying”you can’t pick up one end of the stick without picking up the other end too.” In this case their point was that financial institutions could not avoid the state recording laws and systems and then use those same laws to foreclose.

The Court also leaves open the door for actions in damages against MERS and those who used MERS for wrongful foreclosures.

see Bain Ruling

This is very discouraging and proves our courts in WA state are a crime scene.

Judge Dixon in Thurston County blantantly said The Bains V MERS case had no significance in his court room. Judge Pechman in King County has actually use the Bains Case gaming and manipulating against the homeowners and Leighton in peirce county has put blinders on to MERS docs in cases brough before him and FDCPA cases. Good lawyers and paralegals in the State of WA state constitantly in agreement that the rule of law does not exhist in WA State courts. WE are held hostage by ttheives, thugs meaning the banks and judges.

Pingback: AG Jack Conway Calls MERS a Ghost and a Front – Files a Lawsuit … | House Foreclosure Help

I have recently contacted Senator Patrick Leahy’s office regarding the acquisition by JP Morgan Chase and Co. (JPMC) of the assets of Washington Mutual Bank on September 25, 2008. The assets were worth $308Billion. The Federal Depositi Insurance Corp. was the receiver of WaMu’s assets, and was the seller of those assets to JPMC. JPMC paid $1.88Billion for the assets, a cash amount equal to about 6/10ths of 1 cent on each dollar of value. In other words, JPMC bought the assets for next to nothing. What the Federal government did, when it gave WaMu’s assets to JPMC, was to cause every WaMu customer to be required to do business with JPMC, whether those customers wanted to do business with JPMC or not. This is, of course, a violation of the First Amendment right of freedom of association. There are also property right violations by the government involved as well. Not to mention, there is a good reason to suspect an improper relationship between a governmentment agency regulating banks, and one of the banks it regulates.

My contact with Senator Leahy’s office was for the purpose of persuading the Senator, who is chair of the Senate Judiciary Committee, to take up an investigation of this transaction and it impacts on the country and WaMu’s numerous customers. Senator Leahy’s office advised that the more members of the public who write to the Senator requesting this investigation, the higher the likelihood it will be investigated. Therefore, I am asking any and all who are concerned about the Federal government giving away private property and violating constitutional rights in order to benefit a too big to fail bank – a private corporation – to the detriment of hundreds of thousands, if not millions, of real people, to write to Senator Patrick Leahy and request that he and his committee investigate this giveaway of peoples homes, lives, and money to an avaricious corporation. The Senator’s contact information is at https://www.leahy.senate.gov/contact/ and provides both email, telephone, and letter writing information.

Please write to Senator Leahy. Thank you.

• OUT OF THE MOUTH OF JPMORGAN CHASE: SCHEDULE OF LOANS PURCHASED FROM WAMU DOES NOT EXIST; NO ASSIGNMENTS OF MORTGAGE, NO ALLONGES OR ANY EVIDENCE OF TRANSFERRING OWNERSHIP OF LOANS FROM WAMU TO CHASE

August 21, 2012

August 21, 2012

Confirming, under oath and in print what we already suspected: there is no schedule of mortgage loans evidencing what JPM allegedly “purchased” from the FDIC in connection with the failure of WaMu. This is from the sworn deposition testimony of Lawrence Nardi, the operations unit manager and a mortgage officer for JPM, who was previously with WaMu and was picked up by JPM after WaMu’s failure. The 330 page deposition was taken by counsel for the homeowner on May 9, 2012 in the matter of JPMorgan Chase Bank, N.A. as successor in interest to Washington Mutual Bank v. Waisome, Florida 5th Judicial Circuit Case No. 2009-CA-005717.

Here is the question and the answer:

Q: (page 57, beginning at line 19): Okay. The — are you aware of any type of schedule of loans that would have been created to represent the — either the loans that were asset loans or the loans that were serviced by WAMU? Are you — was the — do you know if there is a schedule or database of loans like that?

A: (page 58, beginning at line 1): I know that there was a schedule contemplated in certain documents related to the purchase. That schedule has never materialized in any form. We’ve looked for it in countless other cases. We’ve never been able to produce it in any previous cases. It would certainly be a wonderful thing to have, but it’s — as far as I know, it doesn’t exist, although it was — it was contemplated in the documents.

As we all know, JPM has also stated, in a Federal Court filing, that it is NOT the “successor in interest to WaMu.” However, the deposition testimony gets even better as the day went on:

Q: (beginning at page 260, line 18): Have you ever in your duties of being a loan analyst — a loan operations specialist, have you ever seen an FDIC bill of sale or a receiver’s deed or an assignment of mortgage or an allonge?

A: (page 260, beginning at line 23): For loans, I’m assuming you’re taling about the WaMu loan that was subject to the purchase here.

Q: (page 261, line 1): Right.

A: (page 261, beginning at line 2): No there is no assignments of mortgage. There’s no allonges. There’s no — in the thousands of loans that I have come into contact with that were a part of this purchase, I’ve never once seen an assignment of mortgage. There is simply not — they don’t exist. Or allonges or anything transferring ownership from WAMU to Chase, in other words. Specifically, endorsements and things like that.

So, JPM allegedly “purchased” mortgage loans from the FDIC out of the WaMu failure, but there is no schedule of what loans were purchased, no assignments, no allonges, no endorsements, nothing that transferred ownership of the loans from WaMu to Chase. However, as we all know, JPM goes around the country touting that it is the “successor in interest to WaMu” (which it has admitted in Federal Court that it is not) and relies on the amorphous “FDIC Affidavit” which, as far as what the “Affidavit” is proffered for, is directly contradicted by the sworn deposition testimony of JPM’s authorized representative WHO WAS FORMERLY WITH WAMU AND WAS PICKED UP BY JPM.

Fraud on the courts, anyone?

Jeff Barnes, Esq., http://www.ForeclosureDefenseNationwide.com

ALSO MICHIGAN SUPREME COURT JUDGES CHASE DID NOT AQCRE WANU LOANS AS A MATTER OF LAW. i WILL POST THIS NEXT

Michigan Supreme court states Chase did not aquire WAMU notes as an operation of law.

Chase owns no WAMU loans, it appears they are only servicier debt collectors like credit cards. http://bpinvestigativeagency.com/are-we-closer-to-checkmate-kim-v-jpmorgan-chase-bank-n-a/

iT APPEARS!! IS CHASE GOING UP IN FLAMES ?

http://bpinvestigativeagency.com/are-we-closer-to-checkmate-kim-v-jpmorgan-chase-bank-n-a/

MIchigan Supreme CT: $3.75 Billion of Chase WAMU Mortgages Are Voidable

http://www.stellionata.com/in-the-news/38-headlines/7662-120509-jpmc-v-waisome-lawrence

–

CHASE DOES NOT OWN THE LOAN!

• OUT OF THE MOUTH OF JPMORGAN CHASE: SCHEDULE OF LOANS PURCHASED FROM WAMU DOES NOT EXIST; NO ASSIGNMENTS OF MORTGAGE, NO ALLONGES OR ANY EVIDENCE OF TRANSFERRING OWNERSHIP OF LOANS FROM WAMU TO CHASE

August 21, 2012

August 21, 2012

Confirming, under oath and in print what we already suspected: there is no schedule of mortgage loans evidencing what JPM allegedly “purchased” from the FDIC in connection with the failure of WaMu. This is from the sworn deposition testimony of Lawrence Nardi, the operations unit manager and a mortgage officer for JPM, who was previously with WaMu and was picked up by JPM after WaMu’s failure. The 330 page deposition was taken by counsel for the homeowner on May 9, 2012 in the matter of JPMorgan Chase Bank, N.A. as successor in interest to Washington Mutual Bank v. Waisome, Florida 5th Judicial Circuit Case No. 2009-CA-005717.

Here is the question and the answer:

Q: (page 57, beginning at line 19): Okay. The — are you aware of any type of schedule of loans that would have been created to represent the — either the loans that were asset loans or the loans that were serviced by WAMU? Are you — was the — do you know if there is a schedule or database of loans like that?

A: (page 58, beginning at line 1): I know that there was a schedule contemplated in certain documents related to the purchase. That schedule has never materialized in any form. We’ve looked for it in countless other cases. We’ve never been able to produce it in any previous cases. It would certainly be a wonderful thing to have, but it’s — as far as I know, it doesn’t exist, although it was — it was contemplated in the documents.

As we all know, JPM has also stated, in a Federal Court filing, that it is NOT the “successor in interest to WaMu.” However, the deposition testimony gets even better as the day went on:

Q: (beginning at page 260, line 18): Have you ever in your duties of being a loan analyst — a loan operations specialist, have you ever seen an FDIC bill of sale or a receiver’s deed or an assignment of mortgage or an allonge?

A: (page 260, beginning at line 23): For loans, I’m assuming you’re taling about the WaMu loan that was subject to the purchase here.

Q: (page 261, line 1): Right.

A: (page 261, beginning at line 2): No there is no assignments of mortgage. There’s no allonges. There’s no — in the thousands of loans that I have come into contact with that were a part of this purchase, I’ve never once seen an assignment of mortgage. There is simply not — they don’t exist. Or allonges or anything transferring ownership from WAMU to Chase, in other words. Specifically, endorsements and things like that.

So, JPM allegedly “purchased” mortgage loans from the FDIC out of the WaMu failure, but there is no schedule of what loans were purchased, no assignments, no allonges, no endorsements, nothing that transferred ownership of the loans from WaMu to Chase. However, as we all know, JPM goes around the country touting that it is the “successor in interest to WaMu” (which it has admitted in Federal Court that it is not) and relies on the amorphous “FDIC Affidavit” which, as far as what the “Affidavit” is proffered for, is directly contradicted by the sworn deposition testimony of JPM’s authorized representative WHO WAS FORMERLY WITH WAMU AND WAS PICKED UP BY JPM.

Fraud on the courts, anyone?

Jeff Barnes, Esq., http://www.ForeclosureDefenseNationwide.com

http://dealbook.nytimes.com/2013/01/23/financial-crisis-lawsuit-suggests-bad-behavior-at-morgan-stanley/

KIM v JPMORGAN CHASE BANK — Acquisition of WAMU Mortgages from FDIC

Finally a taste of justice coming from Michigan.

KIM v JPMORGAN CHASE BANK, NA Docket No. 144690.

Argued October 10, 2012 (Calendar No. 9). Decided December 21, 2012.

In an opinion by Justice MARILYN KELLY, joined by Justices CAVANAGH, MARKMAN, and HATHAWAY, the Supreme Court held:

When a subsequent mortgagee acquires an interest in a mortgage through a voluntary purchase agreement with the FDIC, the mortgage has not been acquired by operation of law and that subsequent mortgagee must comply with the provisions of MCL 600.3204 and record the assignment of the mortgage before foreclosing on the mortgage by advertisement. Any defect or irregularity in a foreclosure proceeding results in a foreclosure that is voidable, not void ab initio.

Court Copy

_________________________________________________________

Commentary and observations from anonymous sender…

We still have no list/schedule of loans owned by WAMU that were allegedly transfered to the FDIC “by operation of law” at the time/date of alleged transfer to the FDIC and unfortunately the court in this case glosses this underlying foundational evidence. But, this is still the initial unresolved problem with evidencing any transfer of any loan from WAMU to the FDIC, but in this case the argument put out by JP Morgan Chase that it acquired these undocumented notes from WAMU via the FDIC by “Operation of Law” is smacked down so there is an absolute need for JPM Chase to produce admissible documentation of the entire transfer of the loan starting with WAMU as originator and including evidence of the complete chain of indorsements, assignments or other contracts to prove up the complete transfer of the negotiable note, assuming the note is a nego instrument. Neither of these transfers – WAMU to FDIC and FDIC to JP Morgan Chase – are likely to be able to be documented with respect to any loan and the track record (to my knowledge) in court so far is proving this “transfer failure” statement to be accurate:

Michigan Supreme Court, 2012 MIch. LEXIS 2220, Kim v JP Morgan Chase, NA., 20121221

Two transfers of plaintiffs’ mortgage occurred on September 25, 2008. The first, between WaMu and the FDIC, was consummated when the Office of Thrift Management closed WaMu and appointed the FDIC as its receiver. This transfer took place pursuant to 12 USC 1821(d)(2)(A)(i) and (ii), which provide that the FDIC “shall, as conservator or receiver, and by operation of law, succeed to . . . all rights, titles, powers, and privileges of the insured depository institution . . . and title to the books, records, and assets of any previous conservator or other legal custodian of such institution.” (Emphasis added.) Thus, when the FDIC succeeded to WaMu’s assets, which included plaintiffs’ mortgage, it did so by clear operation of a statutory provision—12 USC 1821(d)(2)(A). With respect to this transfer, the FDIC acquired plaintiffs’ mortgage by operation of law.

But the FDIC only briefly possessed WaMu’s assets, including plaintiffs’ mortgage. It immediately transferred those assets to defendant. The dispositive question in this case is whether the second transfer of WaMu’s assets—the [*11] transfer from the FDIC to defendant—took place by operation of law.

The seminal case discussing the term “operation of law” in the context of foreclosures by advertisement is Miller v Clark.16 In Miller, a mortgagee died intestate. The Court considered whether the guardian of his heirs was obliged to record an assignment of the mortgage before foreclosing on it by advertisement. The Court held:

The authority to foreclose such mortgages by advertisement is purely statutory, and all the requirements of the statute must be substantially complied with. To entitle a party to foreclose in this manner it is required, among other things, that the mortgage containing such power of sale has been duly recorded; and if it shall have been assigned, that all the assignments thereof shall have been recorded. And also that the notice shall specify the names of the mortgagor and the mortgagee, and of the assignee of the mortgage, if any.

Applying this proposition, we hold that the transfer of WaMu’s assets from the FDIC to Chase did not take place by operation of law. Defendant acquired WaMu’s assets from the FDIC in a voluntary transaction; defendant was not forced to acquire them. Instead, defendant took the affirmative action of voluntarily paying for them. Had defendant not willingly purchased them, it would not have come into possession of plaintiffs’ mortgage. WaMu’s [*14] assets did not pass to defendant “without any act of [defendant’s] own”20 or “regardless of [defendant’s] actual intent.”21 Accordingly, the Court of Appeals correctly concluded that defendant did not acquire WaMu’s assets by operation of law.

http://stopforeclosurefraud.com/2013/01/24/jpmorgan-looks-to-block-shareholder-proposal-on-bank-break-up/

Are We closer To “Checkmate?” – Kim v. JPMorgan Chase Bank, N.A.

Posted by BPIA on Jan 1, 2013 in Uncategorized | 0 comments

If all other states come to the same conclusion as the MI Supreme Court, then Chase has nowhere left to go. This is because both Chase and the FDIC have both stated under oath that no specific schedule of assets was ever produced by the FDIC, or by Chase, per the requirements of the “Purchase & Assumption Agreement.” There is no way of knowing what “certain (WaMu) assets” the FDIC sold to Chase. Therefore, if the assets weren’t acquired by “operation of law,” and there is no proof or evidence specifically showing what WaMu assets were purchased by Chase, how can Chase proceed to foreclose on any WaMu loans as the beneficiary? The only argument left for Chase, as I see it, is “trust us your Honor, we own it.” Call me an optomist, but I don’t think this argument can hold water in a court of law.

KIM v JPMORGAN CHASE BANK, NA Docket No. 144690.

Michigan Supreme Court, 2012 MIch. LEXIS 2220, Kim v JP Morgan Chase, NA., 20121221

Two transfers of plaintiffs’ mortgage occurred on September 25, 2008. The first, between WaMu and the FDIC, was consummated when the Office of Thrift Management closed WaMu and appointed the FDIC as its receiver. This transfer took place pursuant to 12 USC 1821(d)(2)(A)(i) and (ii), which provide that the FDIC “shall, as conservator or receiver, and by operation of law, succeed to . . . all rights, titles, powers, and privileges of the insured depository institution . . . and title to the books, records, and assets of any previous conservator or other legal custodian of such institution.” (Emphasis added.) Thus, when the FDIC succeeded to WaMu’s assets, which included plaintiffs’ mortgage, it did so by clear operation of a statutory provision—12 USC 1821(d)(2)(A). With respect to this transfer, the FDIC acquired plaintiffs’ mortgage by operation of law.

But the FDIC only briefly possessed WaMu’s assets, including plaintiffs’ mortgage. It immediately transferred those assets to defendant. The dispositive question in this case is whether the second transfer of WaMu’s assets—the [*11] transfer from the FDIC to defendant—took place by operation of law.

The seminal case discussing the term “operation of law” in the context of foreclosures by advertisement is Miller v Clark.16 In Miller, a mortgagee died intestate. The Court considered whether the guardian of his heirs was obliged to record an assignment of the mortgage before foreclosing on it by advertisement. The Court held:

The authority to foreclose such mortgages by advertisement is purely statutory, and all the requirements of the statute must be substantially complied with. To entitle a party to foreclose in this manner it is required, among other things, that the mortgage containing such power of sale has been duly recorded; and if it shall have been assigned, that all the assignments thereof shall have been recorded. And also that the notice shall specify the names of the mortgagor and the mortgagee, and of the assignee of the mortgage, if any.

Applying this proposition, we hold that the transfer of WaMu’s assets from the FDIC to Chase did not take place by operation of law. Defendant acquired WaMu’s assets from the FDIC in a voluntary transaction; defendant was not forced to acquire them. Instead, defendant took the affirmative action of voluntarily paying for them. Had defendant not willingly purchased them, it would not have come into possession of plaintiffs’ mortgage. WaMu’s [*14] assets did not pass to defendant “without any act of [defendant’s] own”20 or “regardless of [defendant’s] actual intent.”21Accordingly, the Court of Appeals correctly concluded that defendant did not acquire WaMu’s assets by operation of law.

• 8/16/12 at 11:08 AM

• 97Comments

The Libor Scandal Is About to Hit Home

• By KEVIN ROOSE

Let the Bollinger flow.

Until now, Liborgate has been one of those financial scandals that just barely crawls onto the average American’s radar. Despite revolving aroud a rate that benchmarks roughly $360 trillion in financial instruments, it’s been largely ignored by network news programs, and esoteric enough in its details that it has remained mostly unexplored by Joe and Sue in Peoria (or, alternatively, my Aunt Deborah).

But that’s about to change. Bloomberg reported yesterday that seven banks, including JPMorgan Chase and Citigroup, have now received subpoenas from attorneys general in New York and Connecticut for documents related to their roles in the rate-rigging scandal.

It’s not at all shocking that seven Libor-submitting banks have received subpoenas — news-wise, it’s a bit like reporting that police are questioning a guy who was found at a murder scene with a smoking gun in his hand. And the questions A.G.s Schneiderman and Jepsen are asking the Unlucky Seven are no doubt the same ones people asked Barclays in the wake of its settlement: How widespread were inaccurate Libor submissions? What signals had submitters been given by regulators and their own bosses about how accurate their numbers were supposed to be? Why is Bob Diamond’s daughter so good at Instagramming? (OK, that last one may go unasked.)

But the fact that the Liborgate investigation is now homing in on two American banks (and specifically, on JPMorgan Chase, a bank that has recently proved it can rile Main Street with its misdeeds), means that the general public’s outrage is likely to be significantly more intense than it was when Barclays — an important bank, but a British one — was under fire.

How much more intense? In a perfect world, the public’s anger would be proportionate to the magnitude of Wall Street’s wrongdoing — how many traders and Libor submitters were in cahoots, how flagrantly they lied about their reported rates, and whether senior management knew rate-rigging was happening under their watch.

Sadly, the degree to which Liborgate registers in the U.S. probably depends more on how bad JPMorgan and Citi’s involvement looks — whether the documents turned up by investigators contain any lurid and quotable lines on the order of “Done … for you big boy” or “Come over one day after work and I’m opening a bottle of Bollinger.” or whether any movie-ready characters like the Li-Bros emerge from the probes.

A well-placed source at one of the U.S. banks involved in the Libor investigation told me several weeks ago that the bank had done its own internal investigation, preempting the inevitable subpoenas, and felt fairly confident it had no “bottle of Bollinger”-like skeletons in its closet.

If that’s the case at both JPMorgan and Citigroup, then no number of A.G. probes will stoke Main Street’s fury. But having seen Wall Street step on a rake time and time again when it comes to incriminating e-mails and villainous characters, you can be fairly confident that Liborgate is going to be just as big a hit in the U.S. as it was abroad.

WHAT WAS THAT OLE SAYING DON’T DO THE CRIME IF YOU CAN’T DO THE TIME!

Could you or any one else who wants to write the letter and place it or tag it somewhere that can be uploaded by more people or even a link that can be open to the senators email for proper signature and investigations….

Reblogged this on Justice League.

Pingback: AG Jack Conway Calls MERS a Ghost and a Front – Files a Lawsuit Against MERSCORP Holdings, Inc. |

Pingback: ShellGame-MERS: Contrived Confusion – A MUST READ! | Deadly Clear