By Shelley Erickson

Foreclosures are traumatic. Many have become life-threatening, deadly weapons, creating disease, suicide, heart attacks and numerous other illnesses that have stemmed from fraudulent financial products issued by the banks and some with oversight by Fannie Mae.

Case on point are homeowners with Long Beach Mortgage Company and Washington Mutual mortgages that have a “Jeff Almanza” endorsement on their notes. You don’t see these endorsements when they allegedly happen, the banks wait until you’re in foreclosure to present these altered documents.

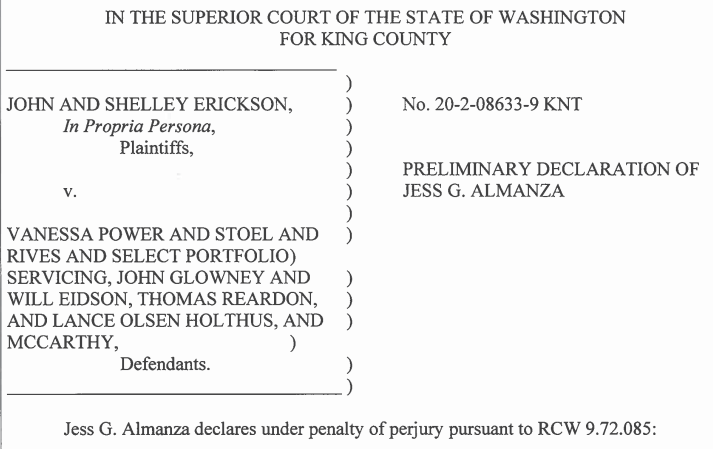

The following excerpts are taken from the Declaration of Jess G. Almanza in the following case involving a Deed of Trust and Note originated in 2006 by Long Beach Mortgage Company. (See also BP Investigative Agency blog).

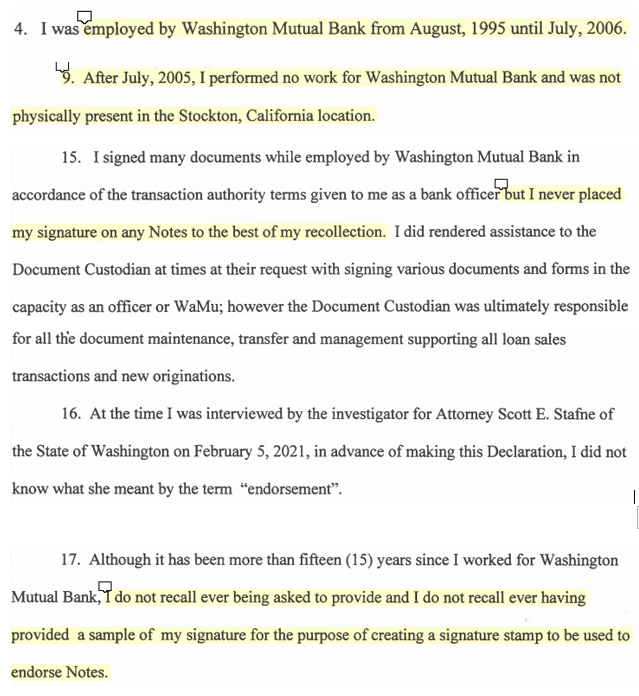

Almanza’s testimony makes clear that he never endorsed notes, never authorized any signature samples for stamps, never gave anyone permission to use his name and signature on endorsements, and didn’t even understand what a note endorsement was.

He performed no work after July 2005, yet his pesky signature appears on countless notes after this time period and well into 2006.

If these are stamps, then who forged his signature in obtaining said “stamps?” If they are not in fact “stamps” but actual signatures, then who forged these signatures? If they are neither stamps nor actual signatures, then who created the computer-generated signatures being applied to the imaged copies the servicers swear are “original?”

Almanza denies any knowledge of these signatures or stamps and states these appear to have been fabricated without his permission.

It appears, Almanza wasn’t the only one in this position. The endorsement stamps were used by other known robo-signers and caught through various testimonies and depositions. See Deposition of Cindy Riley.

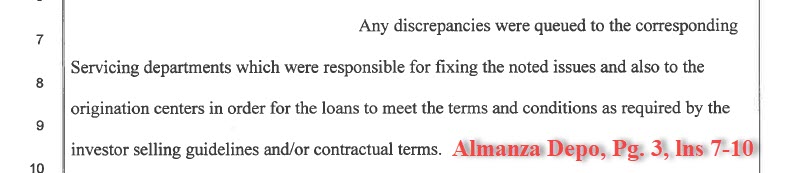

ALMANZA STATES: “Any discrepancies were queued to the corresponding servicing departments which were responsible for fixing the noted issues and also to the origination centers in order for the loans to meet the terms and conditions as required by the investor selling guidelines and /or contractual terms.”

How can someone FIX the collateral file after the fact and the signing of the mortgages?

Sydney’s Corner

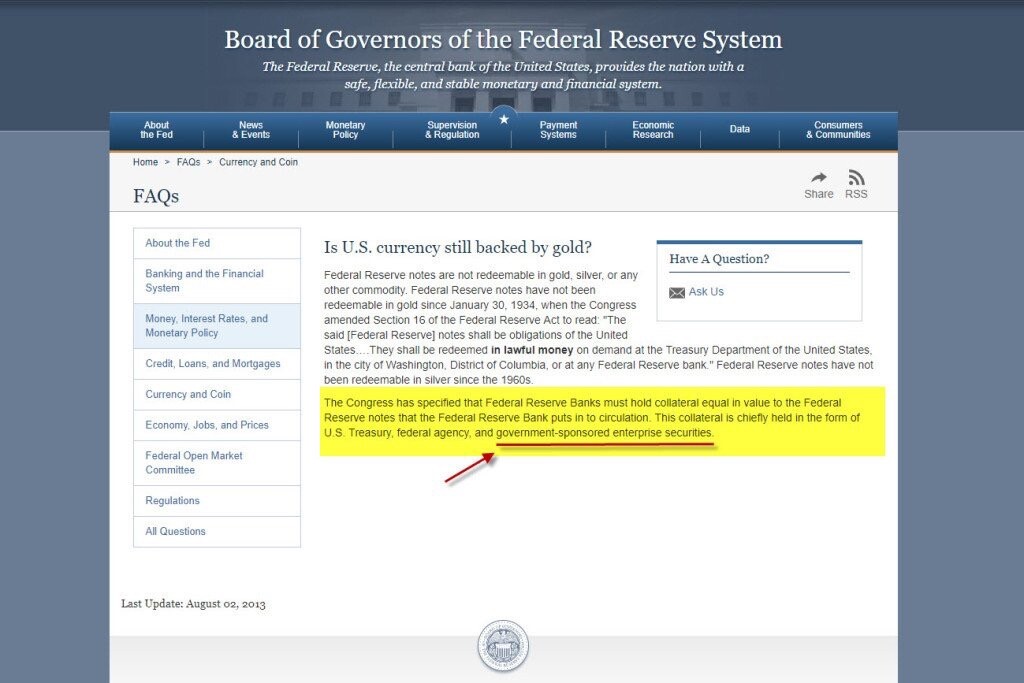

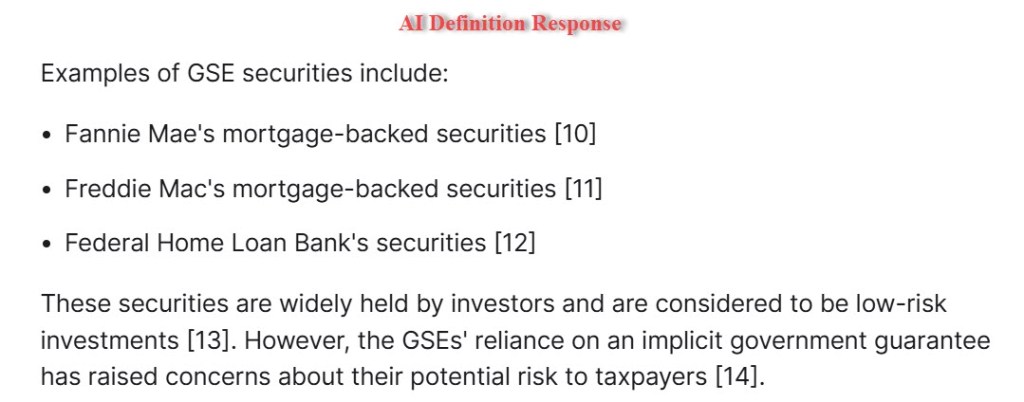

Pursuant to an AI search:

Doesn’t it make you wonder how many Fannie Mae MBS loans are loaded with fraudulently endorsed financial products, not to mention the Federal Reserve…?

i.e. Fannie Mae = Government Sponsored Enterprise; Securities = MBS Mortgage Backed Securities

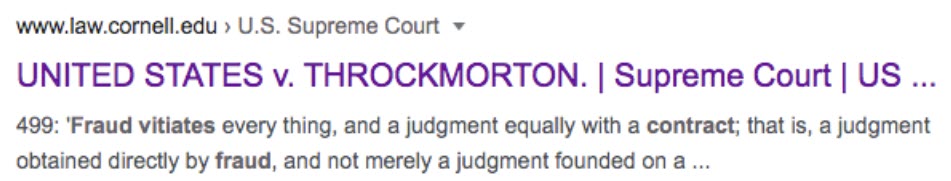

FRAUD RENDERS CONTRACTS AND JUDGMENTS VOID

Stay tuned for Part 2.