OneWest “is not above the law,” said Helen Kelly, a 67-year-old former Minnesota state prosecutor that spoke out during a public hearing on a proposed merger with CIT Group and asserted she encountered difficulties with the lender when she wanted to modify the terms of her mortgage on her Pleasanton, Calif., house. She then compared bankers to an “Ebola virus” that had spread to contaminate homeowners.

The story of OneWest Bank illustrates the federal government’s dubious combination of regulatory indifference and corporate welfare in dealing with the banking industry.

As part of the deal, OneWest agreed to modify mortgages of borrowers, many of them victims of IndyMac scams, so they could avoid foreclosure and stay in their homes.

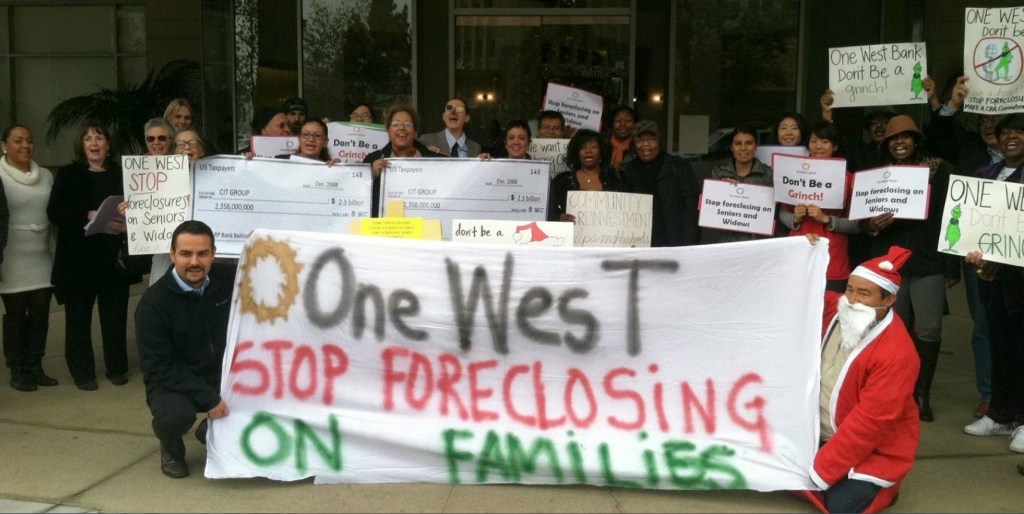

Instead, OneWest has foreclosed on about 36,000 California families, many of them in the greater LA area. The foreclosures are disproportionately in communities of color, which IndyMac targeted with its risky predatory loans and where OneWest has aggressively pursued its eviction strategy. As reported in the San Gabriel Valley Tribune, “68 percent of the foreclosures are in zip codes where the nonwhite population is 50 percent or greater; 35 percent of the foreclosures are in zip codes were the non-white population is more than 75 percent of the total population.”

In other words, OneWest billionaires purchased a foreclosure machine at a huge government-subsidized discount. Rather than slow down or even halt the machine, as they promised to do, they put their foot on the accelerator when it came to interacting with low income residents and minority communities.

To make matters worse, CIT’s $8.8 million-a-year CEO John Thain has bragged to his investors that the merger will allow CIT to take advantage of its prior losses to reduce or even eliminate its federal taxes. READ MORE

Asian Journal writes: “AT A public hearing on CIT Group’s $3.4 billion takeover of OneWest Bank, supporters said the merger would benefit minority groups and poor neighborhoods,

while critics said such an occurrence would create a new “too big to fail” bank. “We have set forth aggressive goals for community investment and development activities in Southern California, including targeting $5 billion of community-related activities over the next four years,” said CIT Group Chairman and CEO John Thain.

Asian Journal writes: “AT A public hearing on CIT Group’s $3.4 billion takeover of OneWest Bank, supporters said the merger would benefit minority groups and poor neighborhoods, while critics said such an occurrence would create a new “too big to fail” bank. “We have set forth aggressive goals for community investment and development activities in Southern California, including targeting $5 billion of community-related activities over the next four years,” said CIT Group Chairman and CEO John Thain.

The Federal Reserve and Office of the Comptroller of the Currency (OCC), which regulates national banks, held the hearing held Thursday, Feb. 26, at the Federal Reserve Bank of San Francisco in Los Angeles. If regulators approve CIT’s purchase, it would be the first merger since the financial crisis to create a bank with assets worth more than $50 billion, a threshold imposed by the US Dodd-Frank law that requires Federal Reserve supervision and more stringent capital rules.

Distressed homeowners and reverse mortgage holders at the hearing also cited personal experiences dealing with mortgage problems.

Teena Colebrook, a member on a panel against the merger, told the audience that notices to rescind her mortgage were ignored in 2011 and 2012 and that she has not yet received accounting of alleged debt she owes. “It should be jail time, not sale time,” she said.

OneWest Bank, created in 2009, came from the remains of IndyMac Bank, a mortgage lender that failed in 2008, costing the federal deposit insurance fund $13.1 billion.

Rebecca Isaac, a panel speaker who started the website IndyMac Complaints, said the bank has not resolved wrongs from years ago and allegedly still owes her money because of alleged violations.” Read more in the Asian Journal HERE.

Reblogged this on Justice League.

Pingback: MUST WATCH: “MY SOUL IS NOT FOR SALE”, OneWest “Is NOT Above The Law” –- Helen Kelly’s Testimony to Fed Reserve Board | Tatumba.com

Reblogged this on wchildblog and commented:

Must Watch

Bank of Ebola . . . good going Helen Kelly!!

brilliant.

This is great. Glad to see people are still out there speaking the truth even if other people are out to lunch. I cannot believe people are not buying gold and silver to protect themselves. https://libertymetals.com/2015/03/us-mint-bullion-sales-down-in-february/