THE NEW YORK TIMES – THE OPINION PAGES

This Is Considered Punishment?

By JOE NOCERA

Published: July 25, 2011

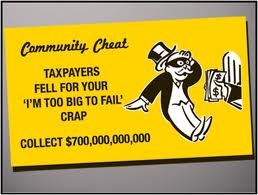

Last Wednesday, nearly lost in the furor over Rupert-gate and the debt ceiling crisis, came the surprising news that the Federal Reserve has issued a cease-and-desist order against a Too-Big-to-Fail bank. The bank was Wells Fargo, which was also fined $85 million and ordered to compensate customers it had unfairly — indeed, illegally — taken advantage of during the subprime bubble.

Last Wednesday, nearly lost in the furor over Rupert-gate and the debt ceiling crisis, came the surprising news that the Federal Reserve has issued a cease-and-desist order against a Too-Big-to-Fail bank. The bank was Wells Fargo, which was also fined $85 million and ordered to compensate customers it had unfairly — indeed, illegally — taken advantage of during the subprime bubble.

What made the news surprising, of course, was that the Federal Reserve has rarely, if ever, taken action against a bank for making predatory loans. Alan Greenspan, the former Fed chairman, didn’t believe in regulation and turned a blind eye to subprime abuses. His successor, Ben Bernanke, is not the ideologue that Greenspan is, but, as an institution, the Fed prefers to coddle banks rather than punish them. That the Fed would crack down on Wells Fargo would seem to suggest a long-overdue awakening.

Yet, for anyone still hoping for justice in the wake of the financial crisis, the news was hardly encouraging. First, the Fed did not force Wells Fargo to admit guilt — and even let the company issue a press release blaming its wrongdoing on a “relatively small group.” The $85 million fine was a joke; in just the last quarter, Wells Fargo’s revenues exceeded $20 billion. And compensating borrowers isn’t going to hurt much either. By my calculation, it won’t top $20 million. [CONTINUE READING]

________________________________________________________________________

By DEADLY CLEAR

Who is Wells Fargo? Isn’t that what you want to know after reading Joe’s opinion column? Wells Fargo is an American multinational diversified financial services company with operations around the world. So, what is an American multinational corporation? A multinational corporation is a corporation or an enterprise that manages production or delivers services in more than one country.

Wells Fargo provides comprehensive personal banking services throughout the world. With its Main Office in Hong Kong & London. Also, as announced on June 9, 2011, Wells Fargo Securities has planned an aggressive expansion of its investment banking practice internationally, adding positions to its existing offices in Asia, Europe, and Latin America.

How “American” does that sound to you? Looks more “Global” than American. About the only thing American going for this multinational conglomerate is its stage coach logo and the fat bailout money it has sucked out of out government. Look out Asia, Europe, and Latin America… you’re next.

Will The Banksters And The Corpocracy Eventually Own It All?

While researching Wells Fargo, this June 6, 2011 post popped up. “Over the past several decades, those with huge amounts of money and power have been busy rigging the game so that the rest of the money and power slowly but surely funnels into their hands. If current trends continue, the banksters and the corpocracy will eventually own it all.”

It continued on a very interesting path, “[I]f you are a “Kool-Aid drinking Democrat” you are going to be really upset by this article. If you are a “Kool-Aid drinking Republican” you are going to be really upset by this article.

Most Republicans have been brainwashed into believing that “capitalism” means cheerleading while the big corporations hoover up money and power.

Most Democrats have no trouble with big corporations either because most establishment Democrats have been brainwashed into believing that large concentrations of power (whether governmental or corporate) are generally good. Most Democrats just wish that big corporations were a little less greedy and were a little more “socially responsible”.

Today, the big banks, the big corporations and the federal government are all in bed with one another and it is the average American that always lose out.” It rings true, yeah?

“Capitalism” is supposed to be about the empowerment of individuals and families and small businesses. Instead, today “capitalism” has come to mean something completely different. Today, the biggest, meanest concentrations of wealth devour everyone else with a big assist from the U.S. government.

At this point, average Americans mean next to nothing in the political process. This point was eloquently made in a recent column by Robert Reich….

“The unemployed are politically invisible. They don’t make major campaign donations. They don’t lobby Congress. There’s no National Association of Unemployed People.

Their ranks are filled with women who had been public employees, single mothers, minorities, young people trying to enter the labor force, and middle-aged men who have been out of work for longer than six months. You couldn’t find a collection of people with less political clout.”

Our founding fathers tried to warn us about large concentrations of power. They attempted to establish a very limited central government, they wanted to keep us free from the tyranny of the big banks and they were very suspicious of large corporations.” [more]

Did we fail to heed our founding father’s warnings? Could this be the banksters and the “too big to fail” problems we are currently experiencing? And should we be concerned? Do we continue to raise the debt ceiling protect these banksters?

Did we fail to heed our founding father’s warnings? Could this be the banksters and the “too big to fail” problems we are currently experiencing? And should we be concerned? Do we continue to raise the debt ceiling protect these banksters?

Certainly, an $85 million fine is a joke when Wells Fargo exceeds $1.2 Trillion in assets.

Wells Fargo produces scam after scam and just keeps going. A friend of mine opened free checking and savings accounts with WF a few months ago. WF ate up the 100 opening deposits to each by way of 15.00 pm svc fees and then socked it to the checking account for a 25.00 overdraft to pay the last savings account monthly fee: 200.00 deposits were lost to WF within a few months and she now owes 25.00 overdraft. Put money in local

credit unions or banks – don’t contribute to banksters’ litigation coffers!